XRP Spot ETF Incoming? 🤔

Bitwise Asset Management makes a major move by filing for an XRP Spot ETF in the U.S.!

Hey Thinkers 💡

Bitwise Files for First US XRP Spot ETF!

Breaking news from the cryptocurrency space as Bitwise Asset Management becomes the first major ETF issuer to file for an XRP Spot Exchange-Traded Fund (ETF). This bold move follows Bitwise’s successful launches of spot Bitcoin and Ethereum ETFs, signaling an expansion of their crypto investment products and a strengthening foothold in the digital asset market.

The filing comes in the wake of Bitwise's acquisition of ETC Group, a European leader in crypto exchange-traded products. The launch of the Bitwise XRP ETP is currently pending the approval of Form S-1, as well as the SEC’s clearance of a Form 19b-4 filing. These regulatory steps are crucial in bringing this innovative financial product to market.

“At Bitwise, we believe blockchains will usher in new, apolitical monetary assets and permissionless applications for the 21st century,” said Bitwise CEO Hunter Horsley. “It’s why for the past seven years we’ve helped investors access the opportunities in the space, and we’re excited to continue that work with our filing for a Bitwise XRP ETP.”

Horsley emphasized the significance of XRP, describing it as “one of the most enduring, well-known assets in the space” with growing recognition among mainstream investors. He further noted Bitwise's continued commitment to bringing these opportunities to investors through their product innovations.

A Race for the First XRP ETF?

Bitwise may not be alone in its pursuit. Canary Capital, a crypto-focused investment firm founded by Steven McClurg, is also vying for an XRP ETF.

Eleanor Terrett of Fox Business identified that the Delaware corporation website lists a recent filing for the Canary XRP ETF, incorporated on September 24th, highlighting growing competition in the space. The ripple effect of this race for an XRP ETF shows that investors are eager to see a spot ETF take hold, especially following XRP’s legal victories.

Grayscale, a leading digital asset manager, also launched an XRP trust in September, offering accredited investors direct exposure to XRP. Grayscale had previously dissolved a similar trust following the SEC’s lawsuit against Ripple Labs in 2020, which accused Ripple of issuing XRP as a security. However, the XRP trust is seen as a major milestone, with many speculating that it could lay the groundwork for a spot XRP ETF in the U.S.

Ripple CEO Weighs In

Ripple CEO Brad Garlinghouse weighed in on the latest developments via X(Twitter), stating: “First BTC, then ETH…it was only a matter of time. This move underscores the growing trust & integration of digital assets like XRP into traditional finance, marking the continued adoption and maturation of the crypto market. I sense this is just the beginning.”

Garlinghouse's comments reflect the overall bullish sentiment surrounding XRP and its potential integration into mainstream finance. The growing interest from institutional investors and ETF issuers signals a strong demand for XRP-based products.

Regulatory Hurdles: What’s Next?

Despite the excitement, there are several key hurdles that must be overcome before an XRP Spot ETF becomes a reality in the U.S. One looming question is whether the SEC will appeal Judge Torres’ ruling in the Ripple case, with the deadline set for October 7th. If the SEC does appeal, could this delay or block the approval of an XRP ETF? It’s worth noting that in the case of Bitcoin ETFs, Grayscale famously sued the SEC for delaying approvals, and a similar scenario could unfold with XRP if regulatory roadblocks persist.

Another consideration is whether an XRP Futures market will be required for a Spot ETF to be approved. While SEC Commissioner Hester Peirce has suggested that a futures market isn’t a strict requirement for a spot ETF, the SEC’s past actions with Bitcoin and Ethereum ETFs suggest that they may favor futures-linked products. This raises concerns about whether the XRP Spot ETF could face delays or challenges similar to those encountered by the Solana ETF filed by VanEck. Here is my recent interview with Commissioner Peirce where she addresses the future market question.

Conclusion: Bullish Outlook with Lingering Questions

The filing of Bitwise’s XRP Spot ETF is an exciting development for XRP investors, potentially bringing this digital asset further into mainstream finance. However, the path forward is filled with regulatory questions and potential obstacles. The crypto community is eagerly watching the SEC’s next moves, particularly as the October 7th deadline for the Ripple case appeal approaches.

Will we see an approved XRP Spot ETF in the U.S.? Only time will tell, but one thing is clear: the demand is there, and institutions like Bitwise are ready to meet it.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Gemini makes it easy to trade crypto with many unique features and prodcuts.

BitGo is one of the top custodians in the crypto industry. They provide the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

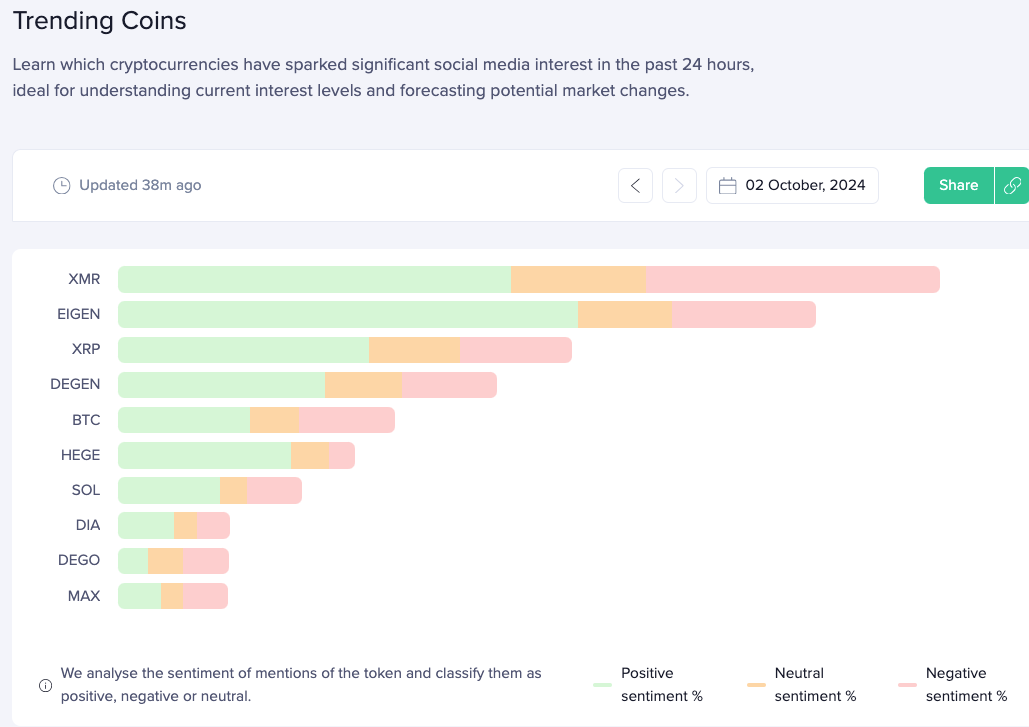

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Hester Peirce is one of the 5 commissioners are the Securities and Exchange Commission (SEC). She joined me to discuss the latest with the SEC and Crypto.

___________________________________________

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony

https://open.substack.com/pub/iamnotaperson528/p/crypto-currency-a-multi-trillion?r=4bip9y&utm_campaign=post&utm_medium=web

It’s exciting to see more mainstream adoption of digital assets.

Do you think the SEC will approve it, or are we in for another long regulatory battle?