Vanguard Capitulates — Bitcoin Poised to Break Out!🚀

Something bullish is forming on the Bitcoin chart—and Vanguard is avoiding its own Blockbuster moment.

Hey Thinkers 💡

There is something bullish happening on the Bitcoin daily chart. The RSI is approaching the oversold zone, and the Bitcoin Fear & Greed Index has officially flipped into fear. Exactly what I’ve been warning about for weeks:

➡️ Flush out the leverage

➡️ Reset sentiment to fear

➡️ Push RSI into oversold territory

This is the perfect setup for a face-melting rally in Q4. If you look back at the daily RSI during the tariff crash earlier this year, we’re approaching the same levels—and that turned out to be a strong bottom.

Here’s a quick refresher: RSI (Relative Strength Index) measures momentum. Oversold levels typically signal exhaustion on the downside, often right before a rebound.

Add in seasonality—Q4 is historically a strong period for stocks and crypto—and the case for a rally strengthens even more.

On-Chain Confirmation

📊 On-chain data from Santiment shows that Bitcoin whales have ramped up accumulation over the past month while prices dipped and retail investors lost hope.

💧 Meanwhile, Global Liquidity continues to climb, signaling there’s still plenty of fuel for this market to run.

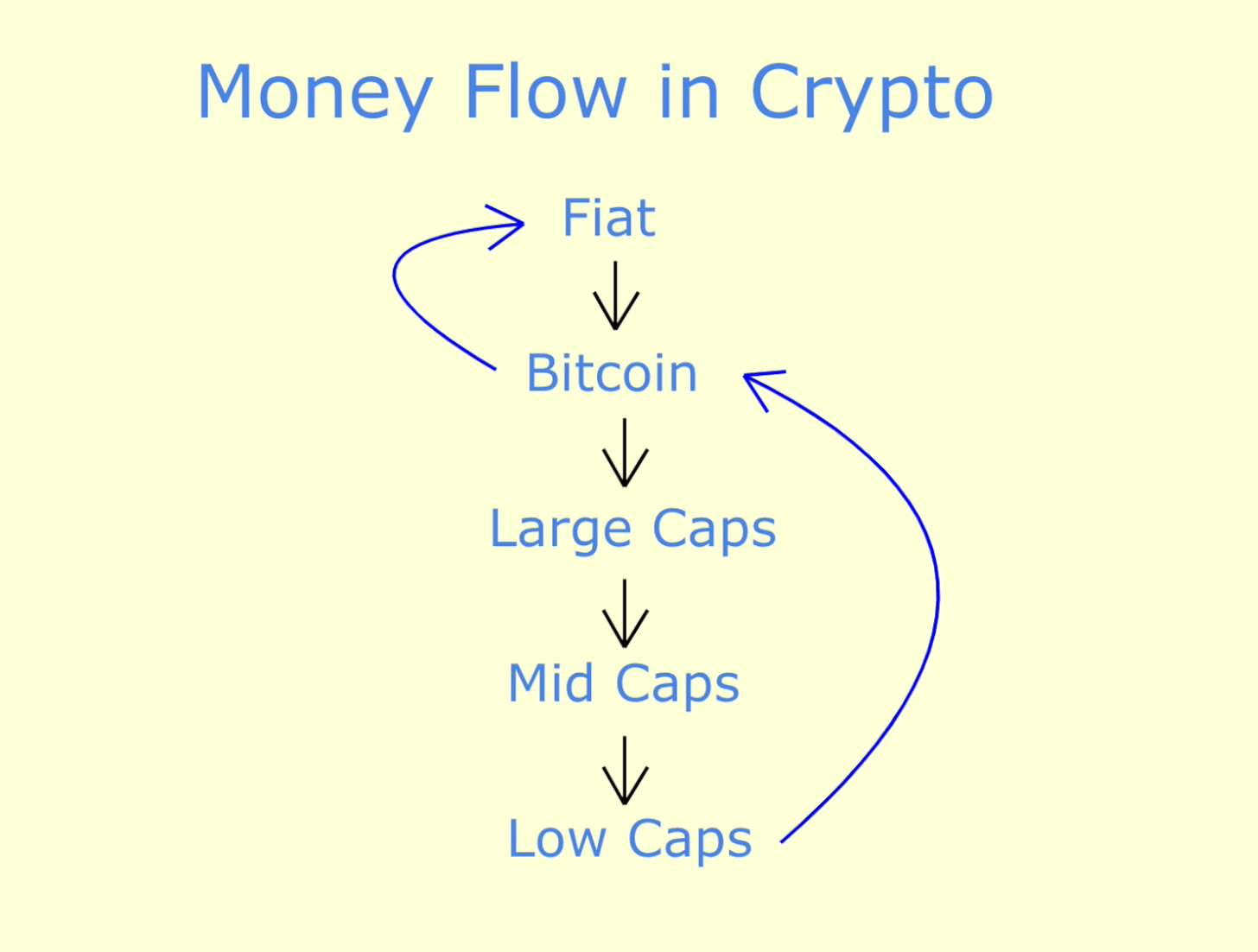

The message here is simple: patience. Bitcoin leads the pack, and once it moves, we’ll likely see the usual rotation of liquidity into altcoins.

Vanguard Bends the Knee!

The dominoes keep falling.

The same week Morgan Stanley announced it is months away from offering crypto trading to retail through its E-Trade division, reports surfaced that Vanguard—the world’s second-largest asset manager—is preparing to allow access to crypto ETFs on its brokerage platform.

This is huge. Vanguard has long been one of the biggest skeptics of crypto. But with new CEO Salim Ramji (formerly of BlackRock and a key figure behind IBIT’s launch), the tide is turning.

Bloomberg’s Eric Balchunas noted on X:

“We heard chatter of this too. Smart of them imo. Bitcoin and Eth ETFs are hugely popular and Salim (the CEO) was one of IBIT’s midwives so he knows.”

Folks, the writing is on the wall: even the skeptics are capitulating. My prediction? Charles Schwab will be next. These on-ramps will funnel billions into the crypto asset class.

🔥 Major Crypto News

BlackRock filed for a registered trust company to back its proposed Bitcoin Premium Income ETF, a yield-generating product that would complement its $87B spot ETF, IBIT. The strategy: sell covered calls on BTC futures to collect premiums.

Kraken raised $500M at a $15B valuation, fueling speculation of a possible IPO later this year. This would join the wave of crypto firms going public.

The Senate Finance Committee will hold a hearing on digital asset taxation on Wednesday, October 1st. With crypto now mainstream, expect lawmakers to sharpen their pencils on tax policy.

Tether is reportedly seeking to raise $15B–$20B in a private placement, valuing the company at levels comparable to OpenAI. The raise would be for a ~3% stake, per Bloomberg.

Final Thoughts

The setup couldn’t be clearer: oversold conditions, whale accumulation, rising global liquidity, and TradFi giants bending the knee.

The market may feel heavy now, but historically these conditions mark the calm before the storm. Q4 could be explosive.

Stay patient. Stay focused. Stay educated.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms. Get an exclusive $100 funding bonus!

___________________________________________

📈Crypto Market Metrics

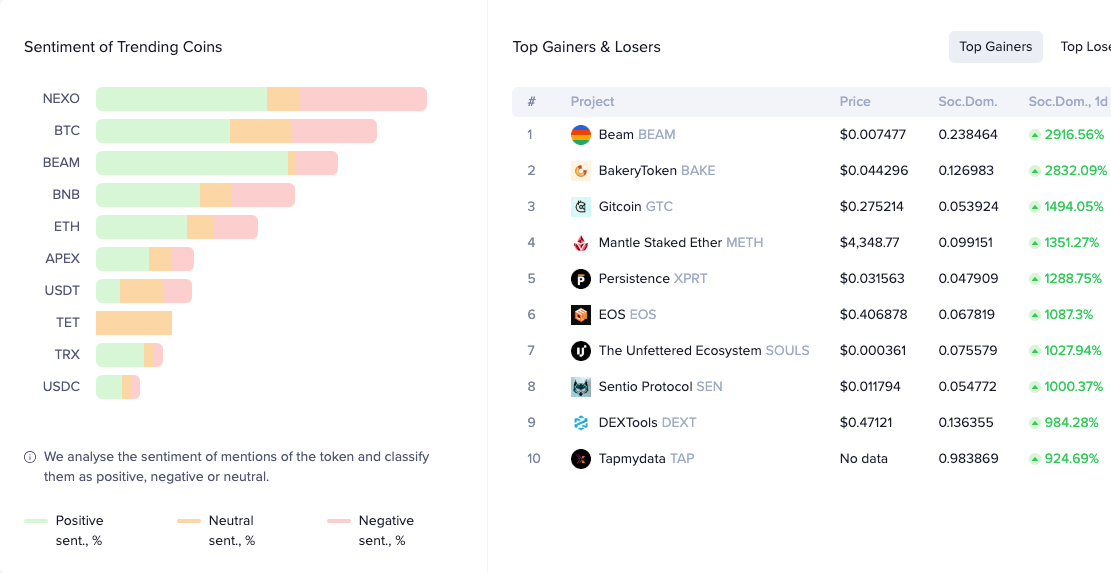

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

Ron Hammond, Head of Policy and Advocacy at Wintermute, joined me to discuss the latest developments on the crypto market structure bill in the Senate.

Zach Pandl, Head of Research at Grayscale Investments, joined me to discuss the SEC’s approval of the Grayscale Digital Large Cap Fund, which includes altcoins such as XRP, Cardano, and Solana.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony