The Real Reason For Trump's Tariff Trade War!🤯

Are USD Stablecoins the catalyst for the Trade War?

Hey Thinkers 💡

Why I Think Trump and the U.S. Are Using Tariffs to Address the Trade Imbalance

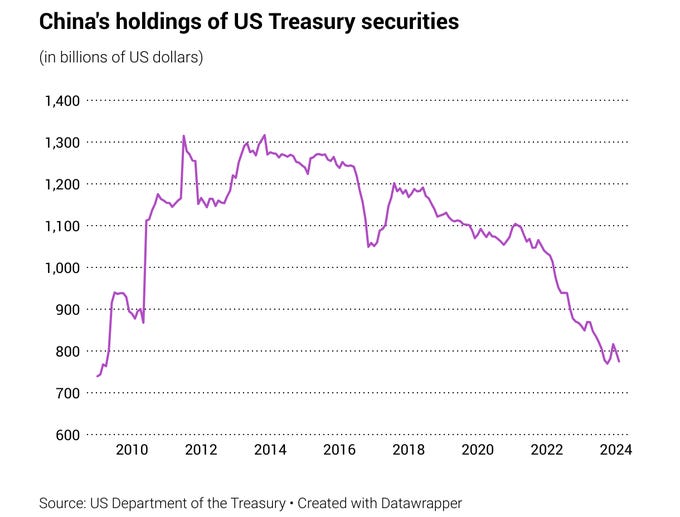

For decades, the U.S. made strategic deals with other countries—like China—that included purchasing U.S. Treasuries. In exchange, those countries received favorable trade terms, shaping the trade landscape we see today.

But something has changed.

Does the U.S. still need these countries to keep buying Treasuries? Not as much anymore. A new, decentralized player has entered the arena: stablecoin issuers. These issuers are rapidly becoming major holders of U.S. Treasuries, even outpacing some foreign governments and traditional financial institutions.

With US stablecoin legislation on the verge of passing, the issuance and adoption of USD-backed stablecoins are set to grow significantly. In February 2025, Bank of America CEO Brian Moynihan said the Bank would launch a stablecoin if stablecoin regulations are passed by United States lawmakers.

This shift reduces the U.S.'s reliance on foreign buyers of Treasuries. As a result, the U.S. can now afford to revisit and renegotiate trade relationships more aggressively—hence the renewed focus on tariffs.

But are these tariffs really about trade? Possibly not. They may simply be a negotiating tactic—a smokescreen. The general public doesn’t fully understand the mechanics of this system. Contrary to the narrative that the U.S. was "taken advantage of," the truth is the U.S. benefited greatly from countries purchasing its Treasuries.

This marks a major shift in how global economics and diplomacy have worked for decades. We’re witnessing the rise of a new monetary era—one where decentralized financial infrastructure plays a central role in sovereign strategy.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Arthur Hayes, co-founder of BitMex and CIO at Maelstrom, joined me to discuss the impact of Tariffs on Bitcoin and the crypto bull market.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony