I’m super bullish on the upcoming Coinbase IPO which is scheduled for April 14th, 2021. I expect the crypto market to be pumping as we get closer to this date. We can certainly expect new all time highs across the board. This is a significant moment in the history of the crypto market as it will signal the merging of the traditional financial world and crypto. It will give more visibility, awareness, and validation of the crypto market. It will also be a major green flag for other crypto companies to IPO. I’m personally going to invest in Coinbase (COIN) stock once available. (Not financial advice)

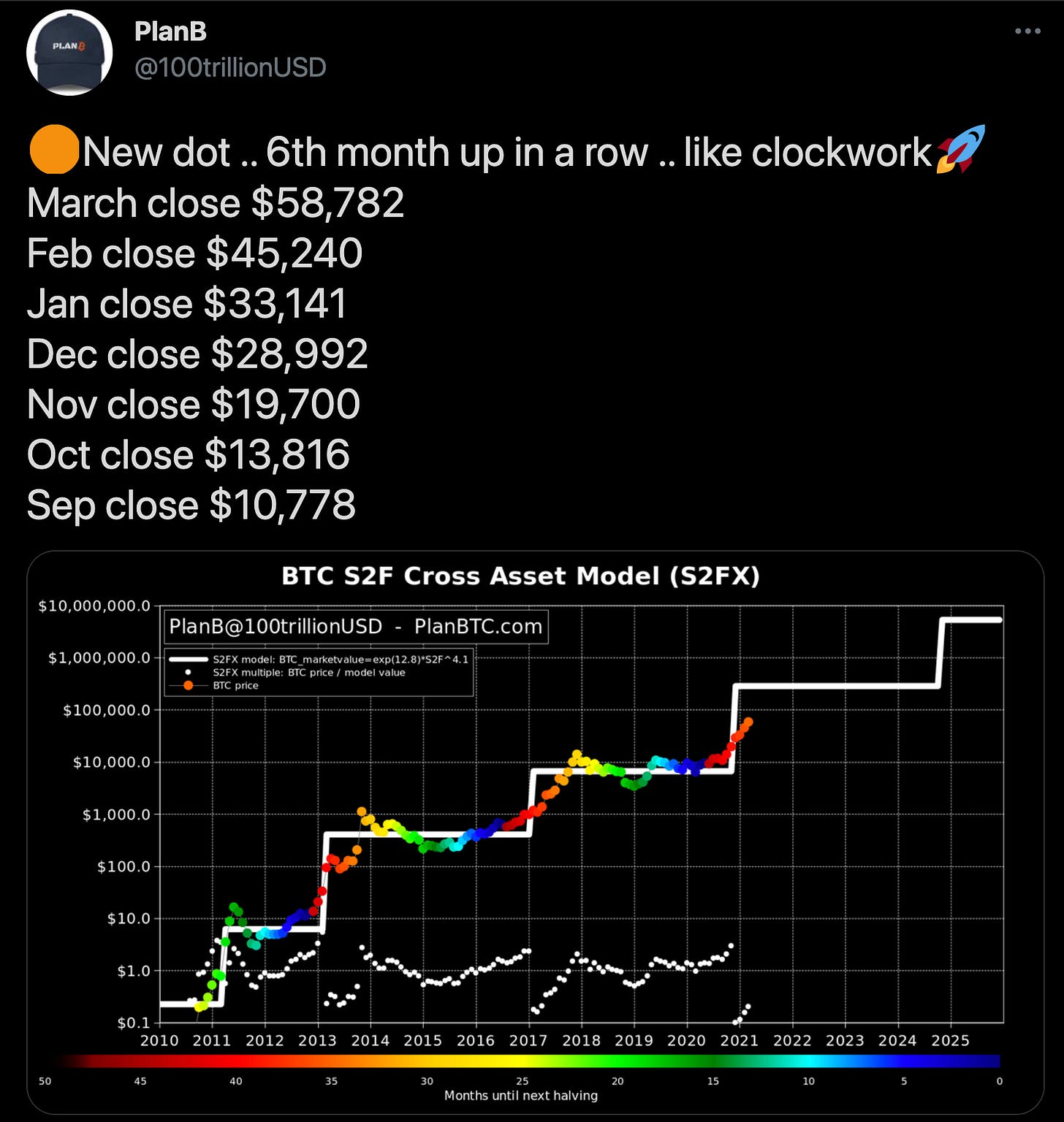

Bitcoin is on track! look at the monthly close outlined below by PlanB. The stock to flow model is playing out like clockwork and we are headed to $100,000. We could potentially go higher than $100K and of course the Altcoins will follow Bitcoins move.

SEC is at it again

The SEC is going after LBRY and of course has a high profile lawsuit against Ripple over the sales of XRP. As I’ve stated in my videos this Ripple lawsuit is crucial for the entire crypto market, the outcome will determine how the SEC handles the other crypto projects. Gary Gensler’s Senate confirmation vote to be chairman of the Securities and Exchange Commission is set for April 12. He is widely expected to be confirmed. I hope Gary comes in and changes a few things and a set of new rules can be used for crypto versus the 70 year old Howey Test.

I interviewed Attorney John Deaton this week regarding the the SEC Ripple lawsuit and his lawsuit on behalf of XRP holders. We touch on the impact the Ripple Lawsuit has on the entire crypto market.

Most bullish news from this week

Goldman Sachs is close to offering bitcoin and other digital assets to its wealth management clients. Goldman is going all in, relaunching their crypto trading desk and giving their wealthy clients exposure to crypto. It will start with Bitcoin and then move to Altcoins. (source)

Coinbase IPO is scheduled for April 14th, 2021. I’m expecting fireworks and a pump from the Coinbase Nasdaq direct listing. (source)

Morgan Stanley is giving a handful of its mutual funds the ability to invest indirectly in through cash-settled futures contracts and Grayscale’s bitcoin trust. (source)

BlackRock is trading Bitcoin Futures according a SEC filing. (source)

Interviews scheduled for next week (4/6-4/9)

Sunny Lu - VeChain CEO

Crypto Taxes

Tax season is about to wrap up in April. Have you prepared your crypto taxes yet for trades made in 2020? Be sure to do so, I personally use TaxBit to help me prepare my crypto taxes which I then share with my accountant. Visit TaxBit’s website to learn more.

-Tony

Disclaimer - Thinking Crypto and Tony are not financial or investment experts. You should do your own research on each cryptocurrency and make your own conclusions and decisions for investment. Invest at your own risk, only invest what you are willing to lose. This newsletter is for educational purposes and NOT investment or financial advice.

Great News ❤️