🐋 The Bitcoin Whales Know Something!

Bitcoin whales continue accumulation with Trump signaling Quantitative Easing.

Hey Thinkers 💡

What a Ride It’s Been…

The past three months have been nothing short of a rollercoaster. Between tariff fears and broader macro uncertainty, both the crypto and stock markets have taken a beating—deeper than what we'd expect from a typical correction after Q4 2024’s rally.

But the volatility may not be over yet. All eyes are on President Trump this week, with his administration set to announce new tariffs on Wednesday, April 2nd.

Markets hate uncertainty. But once we get clarity—whether tariffs are in or out—we could start to see some normalization. What’s more, talk of government stimulus could give risk assets a much-needed boost.

According to a New York Times report this morning, Trump is considering a bailout package for American farmers to help soften the blow of the tariffs.

How would this be funded? Likely through coordination with the Fed and a return to Quantitative Easing (QE). Just weeks ago, Fed Chair Jerome Powell signaled a ramp-down of Quantitative Tightening (QT)—and that sets the stage for more money printing, more liquidity, and in turn, higher asset prices.

And let’s not forget: the weakening U.S. Dollar is another tailwind for crypto and other risk assets.

🐋 Bitcoin Whales Are Buying Again

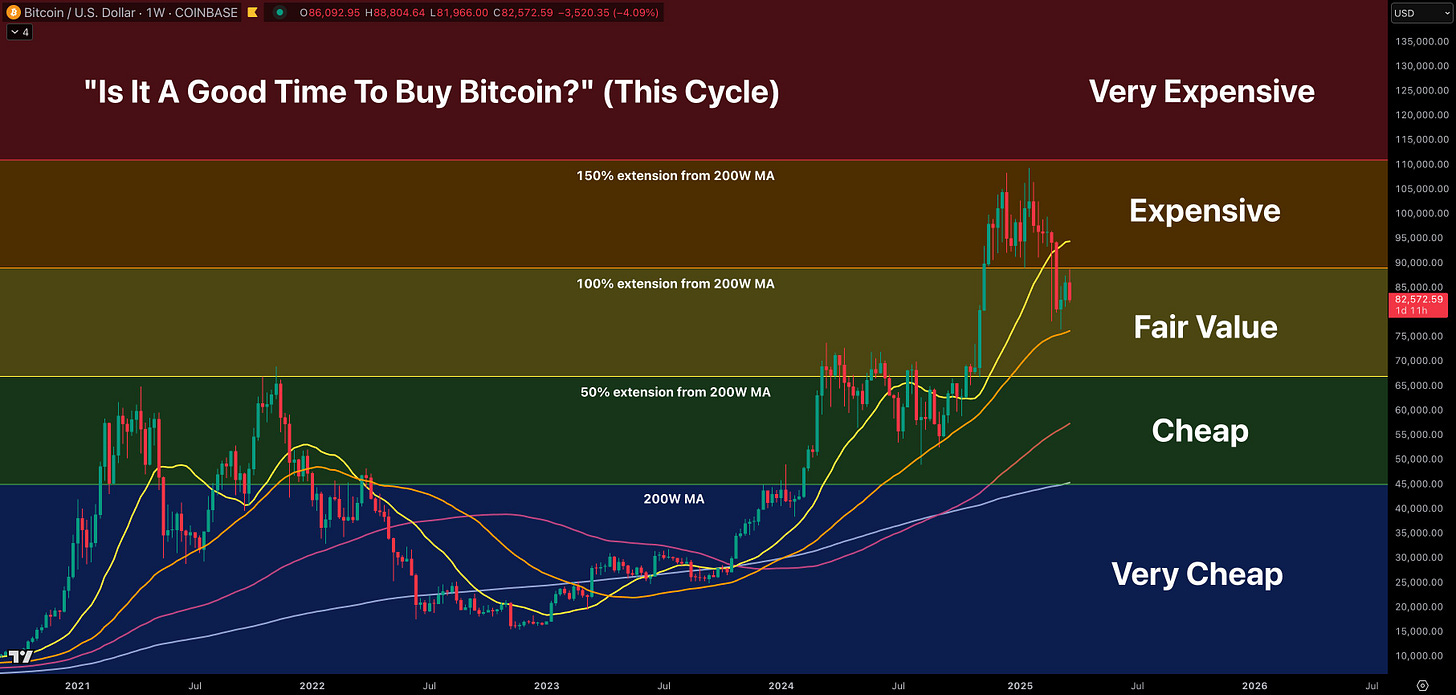

Fresh data from Santiment reveals a spike in Bitcoin wallets holding 10+ BTC. After a lull in accumulation, whales are back on the hunt—buying the dip as BTC returns to fair value.

This behavior suggests they’re front-running a price recovery, stacking sats in anticipation of macro-driven upside.

💼 Circle’s IPO: Bullish Signal

In another vote of confidence for the market, Circle, the issuer of USDC, is reportedly eyeing an April IPO, according to Fortune Magazine. The company is said to be working with JPMorgan and Citi as underwriters.

Would Circle IPO in a bear market? Highly unlikely. Moves like this hint that we’re still in bullish territory, despite short-term turbulence.

🚀 Mega Adoption News — Tariffs or Not

Even with trade tensions rising, crypto adoption is accelerating. Here’s a quick rundown of major developments from the past couple weeks:

Trump Family Launches Bitcoin Mining Venture

In partnership with Hut8, the Trumps are diving into mining. "American Bitcoin Corp", backed by Eric & Don Jr., is set to take over Hut’s Bitcoin ASICs in the U.S.Fidelity Files for Onchain U.S. Treasury Fund

Joining the asset tokenization race, Fidelity’s new fund will live on Ethereum (with potential for multi-chain expansion).BlackRock Launches Bitcoin ETP in Europe

Riding the momentum from the U.S., BlackRock is expanding Bitcoin access across the pond.First Bank-Issued U.S. Stablecoin

Custodia Bank and Vantage Bank drop America’s first bank-issued stablecoin on Ethereum.Trump Media Teams Up with Crypto.com

A surprising twist: Truth Social’s parent company is partnering with Crypto.com to roll out crypto ETFs/ETPs, including products for Bitcoin, CRO, and more.Trump’s USD1 Stablecoin Launch

World Liberty Financial (Trump-affiliated) debuts USD1, a dollar-pegged stablecoin set to launch on Ethereum and BNB Chain, with multi-chain plans ahead.eToro Files for IPO on Nasdaq

Crypto’s growth pays off—eToro’s crypto revenues tripled, and now they’re going public.FDIC Joins OCC in Rolling Back Operation Chokepoint 2.0

A huge win for crypto banking access.Ripple Lawsuit Officially Resolved

Ripple will pay a $50M fine, and the SEC plans to lift the injunction that previously limited XRP sales.Fidelity Stablecoin Incoming

According to Financial Times, Fidelity is deep in testing a new stablecoin, signaling growing TradFi commitment to crypto rails.GameStop Goes Full DeFi

GameStop announces it’s adding Bitcoin to its balance sheet, continuing its transformation from meme stock to crypto-native enterprise.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

BitGo is one of the top custodians in the crypto industry. They provide the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Congressman Bryan Steil, Chairman of Financial Services Subcommittee on Digital Assets, Financial Technology, and Artificial Intelligence, joined me to discuss the latest with Crypto market structure and stablecoin legislation.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony