QT Ends and Stealth QE Has Started!📈

A major monetary shift has taken place, setting the stage for more liquidity to enter the markets — but the bearish signals on the charts are still concerning.

Hey Thinkers 💡

It’s over!

The Federal Reserve has officially ended Quantitative Tightening (QT) — and the liquidity engines are already turning back on.

In fact, the Fed has quietly begun stealth QE, injecting $13.5 BILLION into the U.S. banking system through overnight repos.

👉 This is the 2nd largest liquidity injection since Covid, and it surpasses even the peak of the Dot-Com bubble.

We are watching monetary history unfold in real time.

🏦 Rate Cuts Coming Next?

Markets are now pricing in a 25 bps rate cut at the December 10th FOMC meeting.

Cheaper capital = more fuel for risk assets.

On top of that…

🇺🇸 Trump will soon announce the next Fed Chair.

Powell’s term ends in May 2026, and whoever steps in next will almost certainly:

Cut rates aggressively

Possibly initiate full-scale QE

Work to pump markets ahead of the 2026 midterms

Translation:

The liquidity era is returning — one way or another.

But here’s the big question…

❓ Will Liquidity Save Stocks and Crypto?

Despite the macro tailwinds, the charts still show several bearish signals.

Percentage-wise, this correction is normal. But structurally we’re at a crossroads.

We are now seeing a bounce in both Bitcoin and the stock market — and it feels like a battle between:

🟦 MACRO BULL SIGNALS

vs.

🔻 CHART BEAR SIGNALS

Two scenarios are now most likely:

Scenario 1: Relief Rally → Bear Market

A bounce that fails to break resistance, rolls over, and confirms a macro top.

Scenario 2: Next Leg Up → New All-Time Highs

A breakout that kicks off the final euphoric run of the cycle.

A key indicator:

Bitcoin’s daily death cross has historically aligned with local bottoms, not tops.

That’s worth paying attention to.

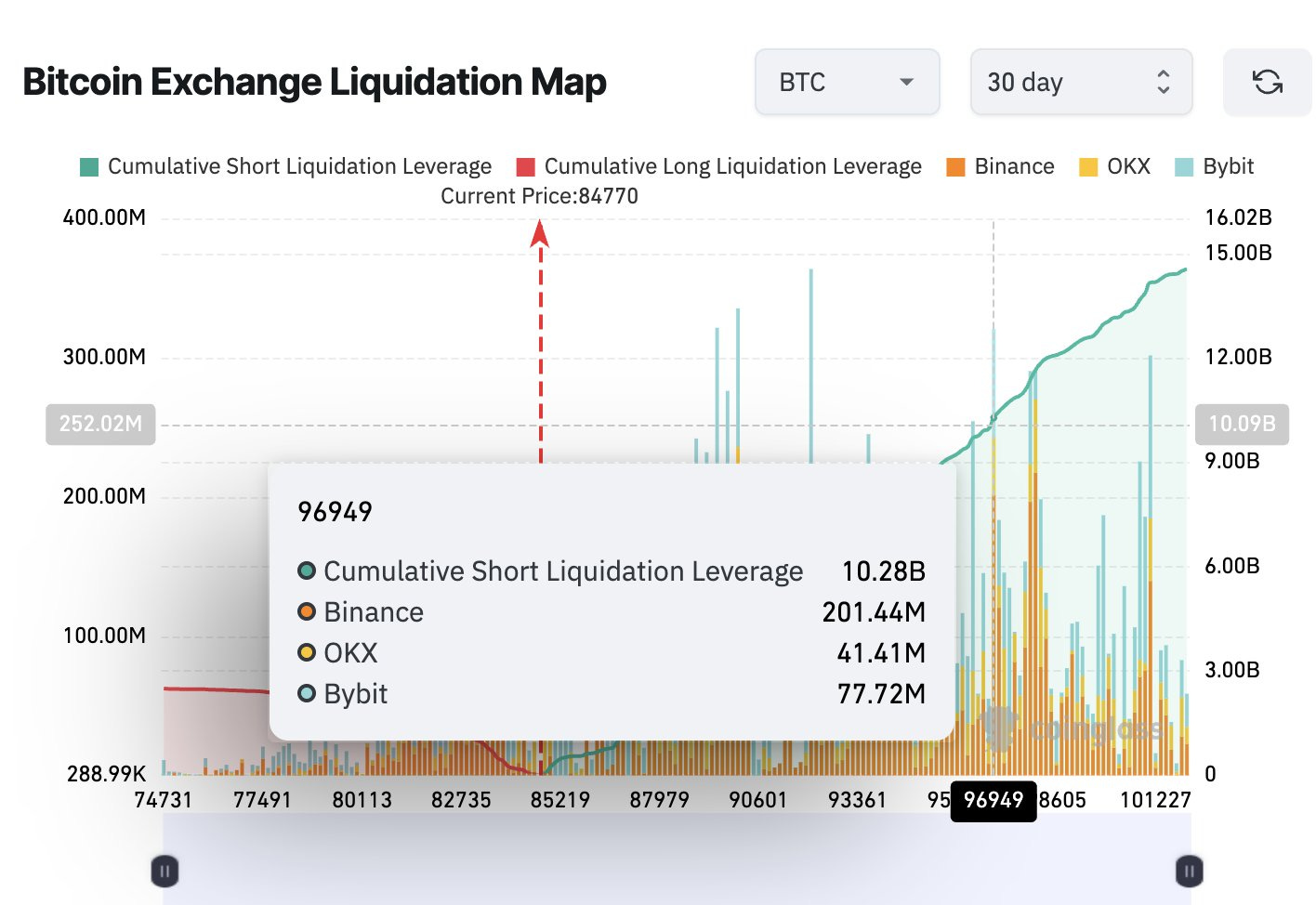

💥 Short Squeeze Setup: $10.2B in Shorts on the Line

If Bitcoin taps $96.9K, about $10.2 BILLION in short leverage would be liquidated.

That could trigger:

A violent short squeeze

BTC reclaiming $100,000+

Altcoins waking back up

A wave of forced buying

In the short term, both scenarios lead to higher prices.

The real question is what happens after the squeeze.

🏛️ Macro Tailwind: SEC Signaling a Bull Market

This morning, SEC Chair Paul Atkins spoke at the NYSE announcing:

🔹 IPO-boosting policies are coming in early 2025

Reminder:

No one goes public in a bear market.

And many crypto + AI companies are lining up:

Securitize

Kraken

OpenAI

Blockchain infrastructure firms

Atkins also said:

🌐 An “innovation exemption” for crypto companies is coming in January.

Pair this with the crypto market structure bill, expected to pass the Senate in early 2026…

You have the ingredients for a “buy the rumor, sell the news” mega-event.

🐋 Whale Red Flag: Distribution Continues

One area of legitimate concern:

Onchain data from Santiment shows whales (10+ BTC wallets) are distributing.

Accumulation has paused. Distribution has increased.

To be fair:

Q2 2024 saw massive whale selling after the Bitcoin Spot ETF approval

They later resumed accumulation

But there’s no guarantee whales repeat old behavior. This is a metric we must track closely.

🧘 The Truth: We Are In a Moment of Extreme Uncertainty

This is one of the most uncertain periods of the entire cycle.

We need:

Patience

Emotional control

Vigilance at key resistance levels

What Bitcoin and the stock market do next — reject or break out — will decide the next year of price action.

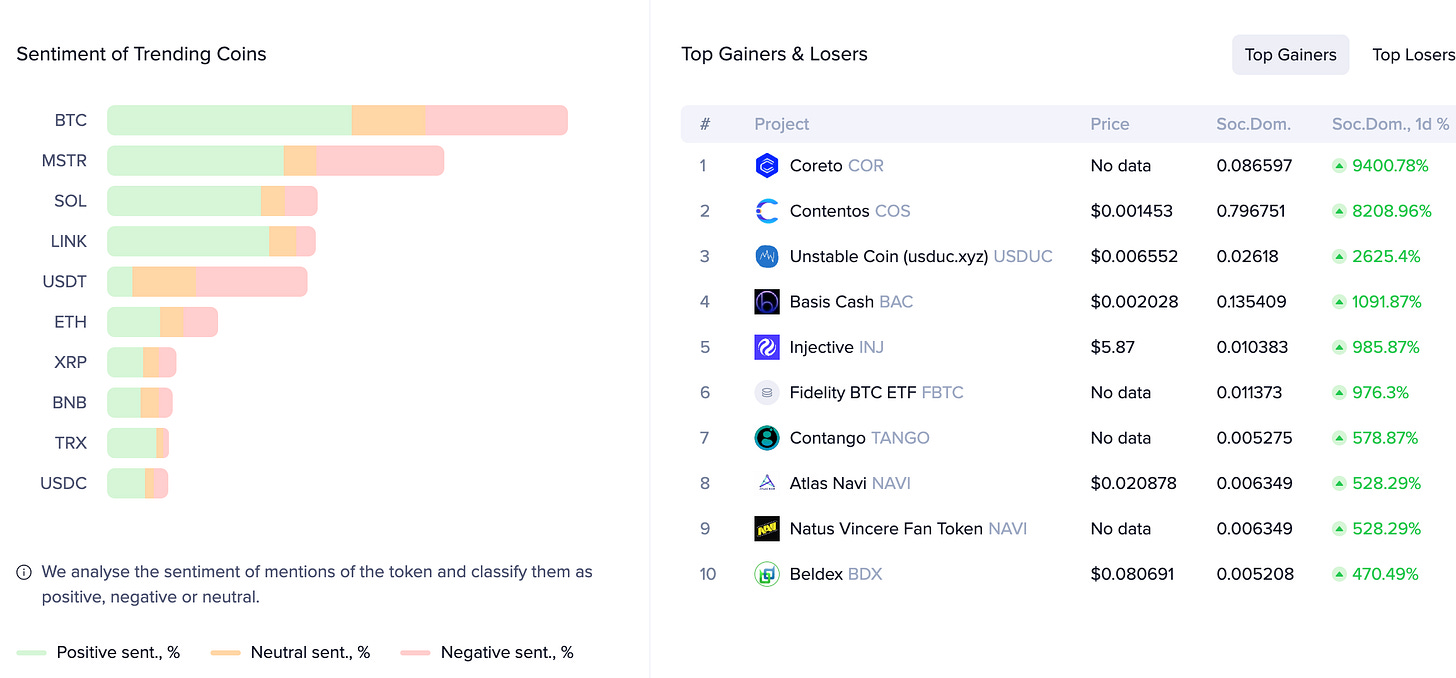

For deeper context, watch my latest interview with Brian from Santiment.

We break down on-chain metrics for Bitcoin, Ethereum, XRP, Solana, and Zcash.

🔥 Major Crypto News

1️⃣ Vanguard Bends the Knee

In a massive reversal, Vanguard will now allow trading of spot crypto ETFs on its brokerage platform.

That includes:

BTC

ETH

XRP

SOL

This comes after then-CEO Tim Buckley famously declared:

“Bitcoin isn’t a store of value. We’ll never offer ETFs.”

They still claim they won’t launch their own ETFs — but the floodgates to crypto exposure for millions of users just opened.

It’s also important to note that this morning, Bank of America announced it will allow its wealth management advisers to recommend a 1%–4% allocation to crypto assets starting in January 2026.

2️⃣ Sony Plans U.S. Dollar-Backed Stablecoin

Sony Bank is preparing to launch a USD-pegged stablecoin in 2026 for use across the entire Sony ecosystem.

Expected use cases:

PlayStation game purchases

PlayStation subscriptions

Anime and digital content

In-app and in-platform payments

Sony entering the stablecoin race is another sign that Web2 and Tech giants are going onchain.

🧩 Final Thoughts

The end of QT is massive.

Stealth QE is already here.

Liquidity is turning.

More rate cuts are coming.

Regulatory winds are shifting.

But charts are conflicted.

Whales are distributing.

And uncertainty is high.

The next three months will define the fate of this bull market.

Stay sharp. Stay patient. Stay ready.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms. Get an exclusive $100 funding bonus!

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

Aaron Arnold of Altcoin Daily sat down with me at Chainlink SmartCon to discuss the current state of the crypto market and more

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony