Bitcoin threw us a curve ball by having a pullback instead of breaking upwards to $75,000. It is building support levels at the $58,000 price point which is healthy for its growth overtime.

However, from a macro level we are looking very bullish. PlanB’s stock to flow model(S2F) is on track and in fact the S2FX is looking like the stronger scenario with Bitcoin potentially hitting $288,000 later this year.

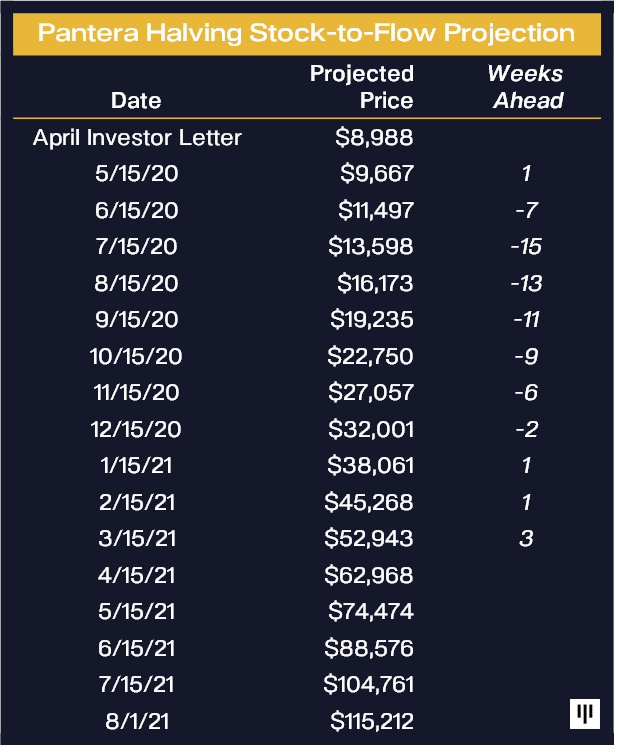

Dan Morehead’s price prediction chart is ahead right now and he is looking for a $115,000 Bitcoin price by August of this year. Watch my interview with Dan where he talks about this price prediction.

Patience is the key here as Bitcoin makes it way upwards and the altcoins follow.

Most bullish news from this week

Morgan Stanley becomes the first major U.S. bank to offer its wealthy clients access to Bitcoin funds. Two of the funds on offer are from Galaxy Digital, a crypto firm founded by Mike Novogratz, while the third is a joint effort from asset manager FS Investments and bitcoin company NYDIG. This is huge news and very bullish as it shows the mega banks can no longer ignore Bitcoin and the crypto market anymore.(source)

Deutsche Bank puts out a report stating Bitcoin is “too important to ignore” given its $1 trillion market capitalization. It seems every bank is turning bullish and this follows the trend of positive statements from the likes of JP Morgan, Citi, Goldman Sachs and more. (source)

Crypto custody firm Fireblocks raises $133 million from a variety of investors including BNY Mellon, the world’s largest custodial bank. Keep an eye on BNY Mellon, they are looking to gain a lot of market share in crypto. (source)

NFT marketplace OpenSea raises $23 million from a16z. This is a big endorsement of NFTs as the folks at Andreessen Horowitz don’t just invest in any industry or company, they have made smart bets going back to the dot-com era. This is another signal that NFTs are here to stay. (source)

Weird News

Elon Musk published a video on Twitter saying he selling it as an NFT. He then later withdraws the sale of it.

Interview Recap

I had a great interview with Ripple CTO David Schwartz this week. He and the team at Ripple continue to work on great solutions with XRP and the XRP ledger. What is interesting is Ripple’s plan to have Private Ledgers built for Central Banks to launch their CBDCs on. These Private Ledgers will be powered by the same blockchain technology as Ripple's public XRP Ledger (XRPL). David ties it all together and explains how XRP will be be used as a bridge asset and much more.

Interviews scheduled for next week (3/22-3/26)

Diogo Monica - Co-founder and President of Anchorage

Congressman Warren Davidson - Crypto advocate and creator of the token taxonomy act

Attorney Jeremy Hogan - We will discuss his take on the SEC lawsuit against Ripple, XRP, and Crypto regulations.

Crypto Taxes

Tax season is about to wrap up as we approach April. Have you prepared your crypto taxes yet for trades made in 2020? Be sure to do so, I personally use TaxBit to help me prepare my crypto taxes which I then share with my accountant. Visit TaxBit’s website to learn more.

-Tony

Disclaimer - Thinking Crypto and Tony are not financial or investment experts. You should do your own research on each cryptocurrency and make your own conclusions and decisions for investment. Invest at your own risk, only invest what you are willing to lose. This newsletter is for educational purposes and NOT investment or financial advice.

Great Marketing strategy ❤️❤️