Hey Thinkers 💡

This week has been nothing short of historic for crypto adoption. We're seeing moves that were once unthinkable, but now confirm the inevitable march toward global integration of digital assets. Here’s a breakdown of the top developments:

🇺🇸 U.S. Labor Department Clears the Way for Bitcoin in 401(k)s

In a landmark decision, the U.S. Department of Labor has officially rescinded its previous guidance warning against the inclusion of crypto in 401(k) retirement plans.

This opens the floodgates for Bitcoin and other cryptocurrencies to become part of mainstream retirement investment portfolios. Expect to see massive flows of capital as financial advisors, fund managers, and retirement custodians adjust to this new era.

🕹️ GameStop Buys 4,710 Bitcoin Worth $512 Million

GameStop just made a massive bet on Bitcoin, purchasing 4,710 BTC in a move worth over $512 million.

This was foreshadowed by GameStop CEO Ryan Cohen posting a photo with none other than Michael Saylor back in February. Now it’s official—GameStop is following the MicroStrategy corporate treasury playbook, signaling that more public companies may soon follow suit.

🏦 Cantor Fitzgerald Launches $2B Bitcoin-Backed Lending Program

Wall Street is getting deeper into Bitcoin. Cantor Fitzgerald has kicked off a $2 billion BTC-backed lending initiative, with financing deals already in place for FalconX and Maple Finance.

"Institutions holding bitcoin are looking to broaden their access to diverse funding sources," said Christian Wall, co-CEO of Cantor.

This is another major step in building a fully developed institutional-grade Bitcoin financial ecosystem.

🎯 Ethereum Treasury Playbook: SharpLink Gaming & Joseph Lubin

Betting platform SharpLink Gaming, listed on Nasdaq, has launched an Ethereum-based corporate treasury strategy and appointed Ethereum co-founder Joseph Lubin as chairman of the board.

The company secured a $425 million PIPE deal involving Consensys as an investor. This is Ethereum’s version of the Michael Saylor playbook—and it could be even more powerful due to ETH staking rewards.

“Consensys looks forward to partnering with SharpLink to explore and develop an Ethereum Treasury Strategy,” said Lubin.

🪙 Circle Files for IPO on NYSE

Circle, the issuer of USDC, has officially filed to go public on the New York Stock Exchange.

This ends speculation around potential acquisitions by Ripple or Coinbase and signals Circle’s confidence in its future. With stablecoin legislation progressing through the Senate, Circle is positioned for exponential growth.

🏠 Avalanche to Power $240B Real Estate Tokenization in New Jersey

Bergen County, NJ is moving its entire property deed system onto Avalanche’s blockchain, tokenizing 370,000 property records—a combined value of $240 billion.

This is now the largest real estate tokenization initiative in the United States, launched in partnership with Balcony under a five-year deal. Enterprise blockchain adoption is accelerating fast.

📉 Bitcoin Price Pullback – Nothing to Fear

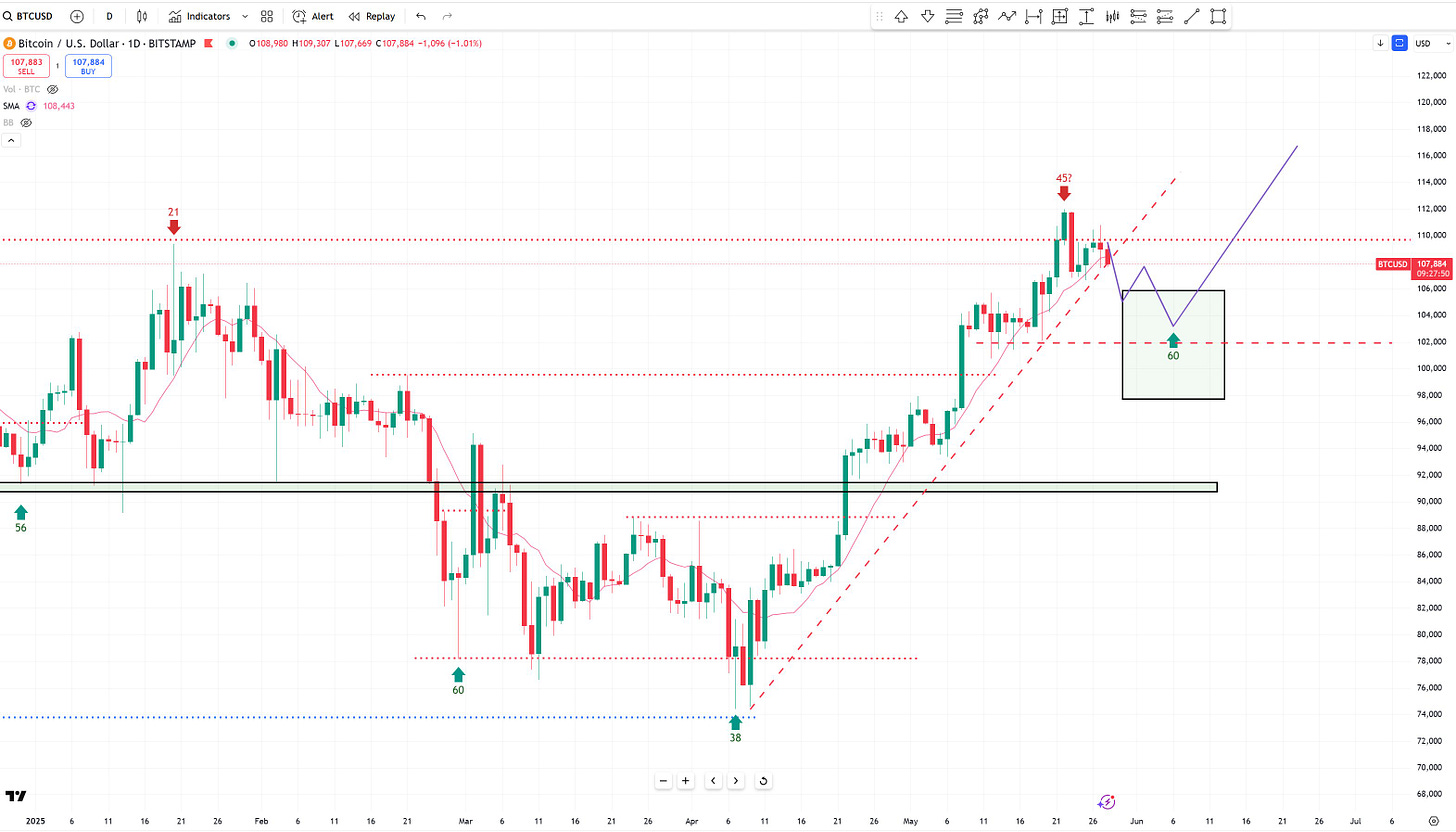

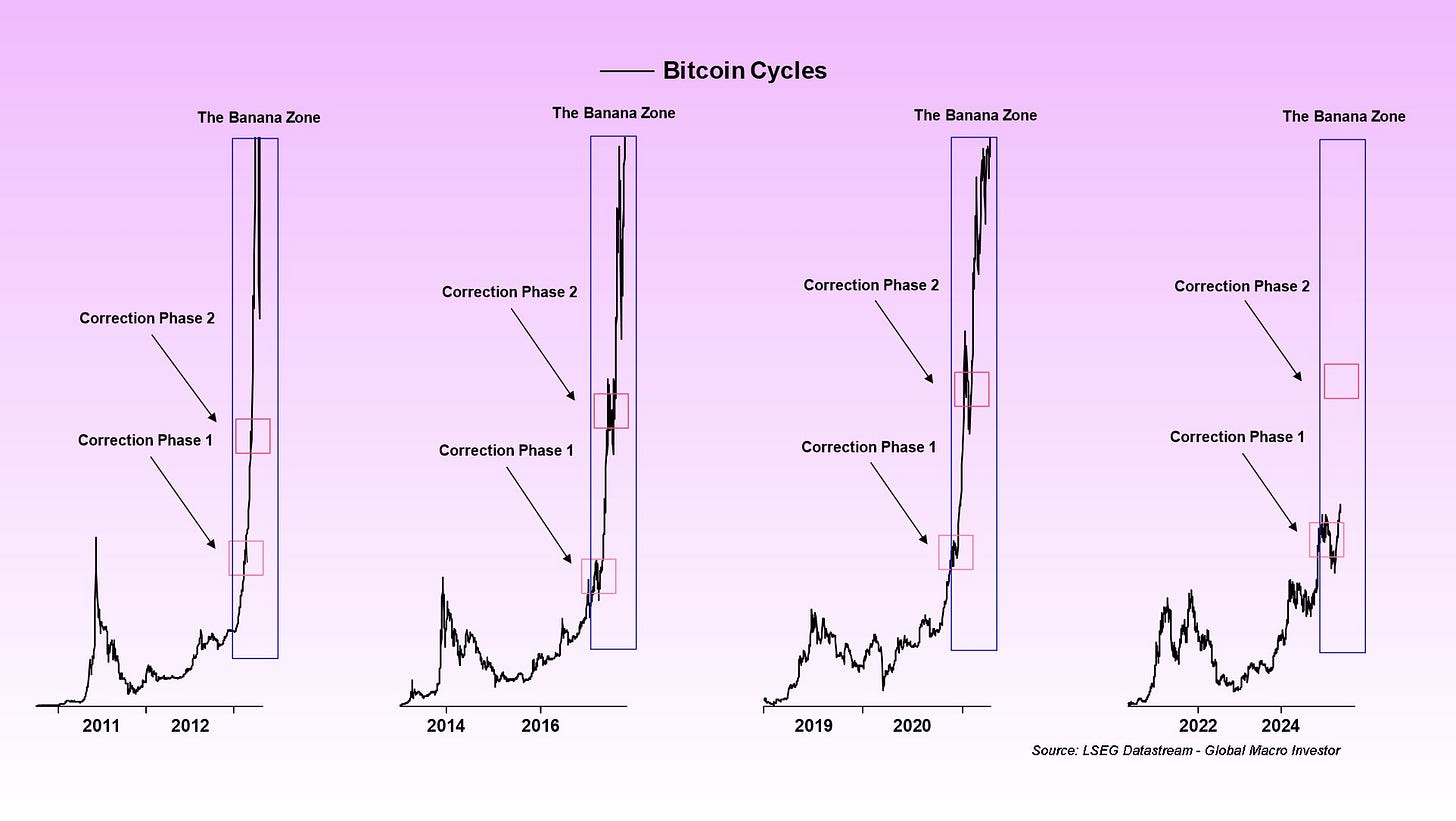

If you’ve noticed some pullback in Bitcoin’s price, don’t worry—it’s healthy and expected.

On the daily chart, RSI was deep in the overbought zone, and now we’re seeing a natural correction.

Crypto analyst Bob Loukas puts it well:

“We should welcome a healthy little Bitcoin pullback to complete the 1st 60-day cycle. They aid in refueling a sustainable bull trend.”

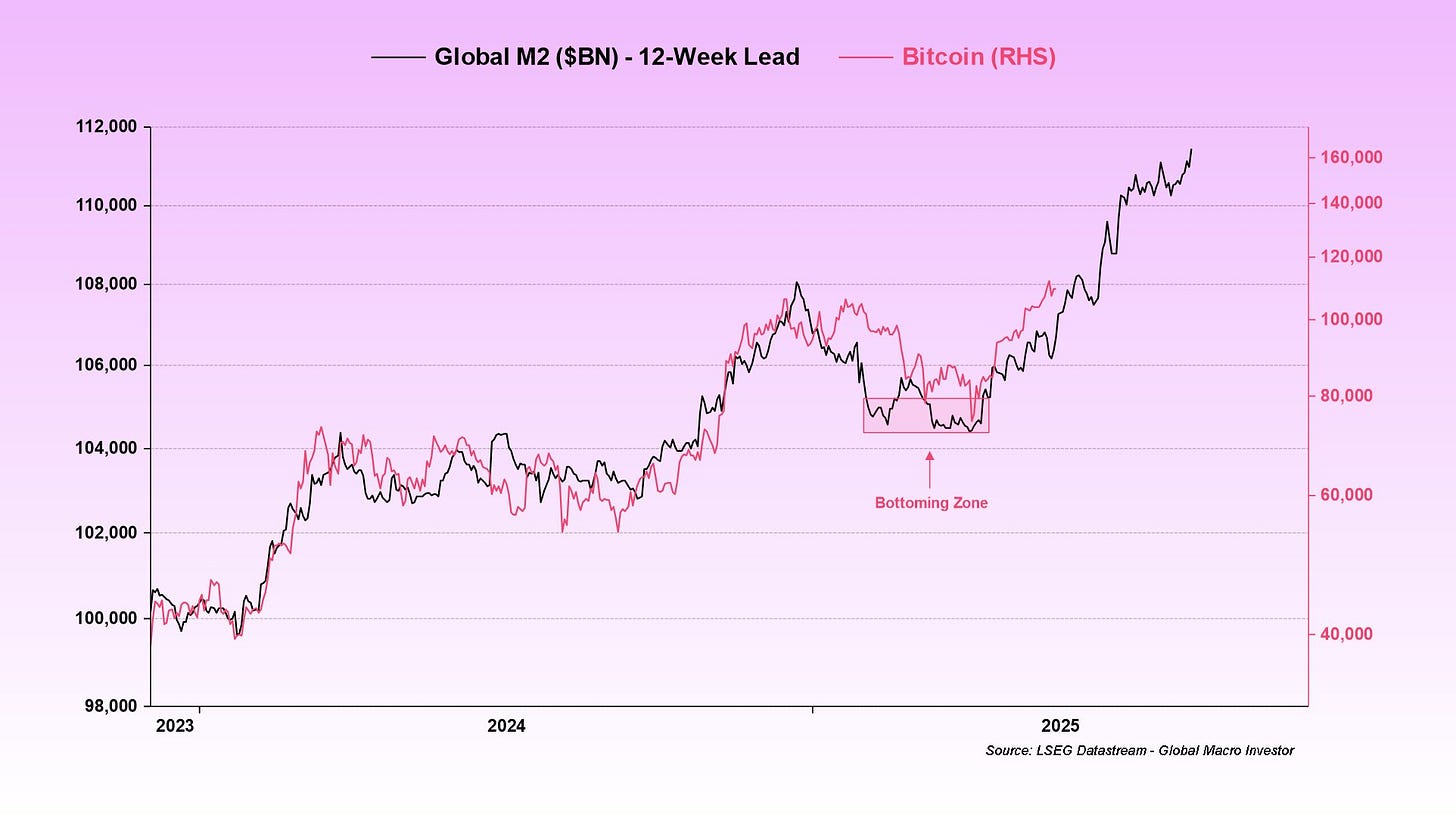

Zooming out, macro indicators remain extremely bullish—especially global liquidity, which continues to rise and signal higher prices ahead.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

John Rising, co-founder and CEO of Stackup, joined me to discuss how his company is helping enterprises to adopt crypto.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony