Is the Worst Over for Crypto?🤔

Bitcoin has been in a free fall, but is the bottom in? Will we see a major reversal soon?

Hey Thinkers 💡

The pain continues. It’s been a brutal stretch in the crypto market — for everyone except the short sellers. But if we strip away the emotion and zoom out, we know the truth:

Markets are cyclical.

They never move in one direction forever — not up, not down.

Crypto is no different.

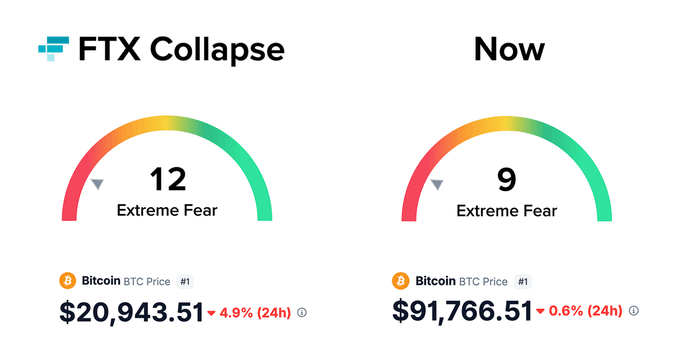

Markets are driven by liquidity and sentiment, and while liquidity is building on the horizon, sentiment has plunged into extreme fear, hitting levels even worse than the FTX collapse and Covid crash.

Let’s break down what’s happening — and what matters next.

🌪️ What’s Weighing on the Market?

A combination of unusual events has created the most chaotic mid-cycle stretch we’ve seen in years:

1️⃣ Tariffs — the unexpected macro wrecking ball

This cycle’s curveball. Tariffs introduced a massive macro headwind that:

Pushed the cycle timeline back

Disrupted liquidity flows

Triggered one of the biggest leveraged flush-outs ever

2️⃣ The U.S. government shutdown

A 40+ day shutdown clogged liquidity pipelines and froze government activity — including SEC approvals and fiscal operations.

3️⃣ Competing narratives siphoning capital

AI and Gold have become massive liquidity magnets, diverting capital that historically flowed into crypto mid- and late-cycle.

It’s been a perfect storm.

🟦 Signs Bitcoin Is Near a Bottom

Despite the chaos, Bitcoin is showing signs it may be bottoming:

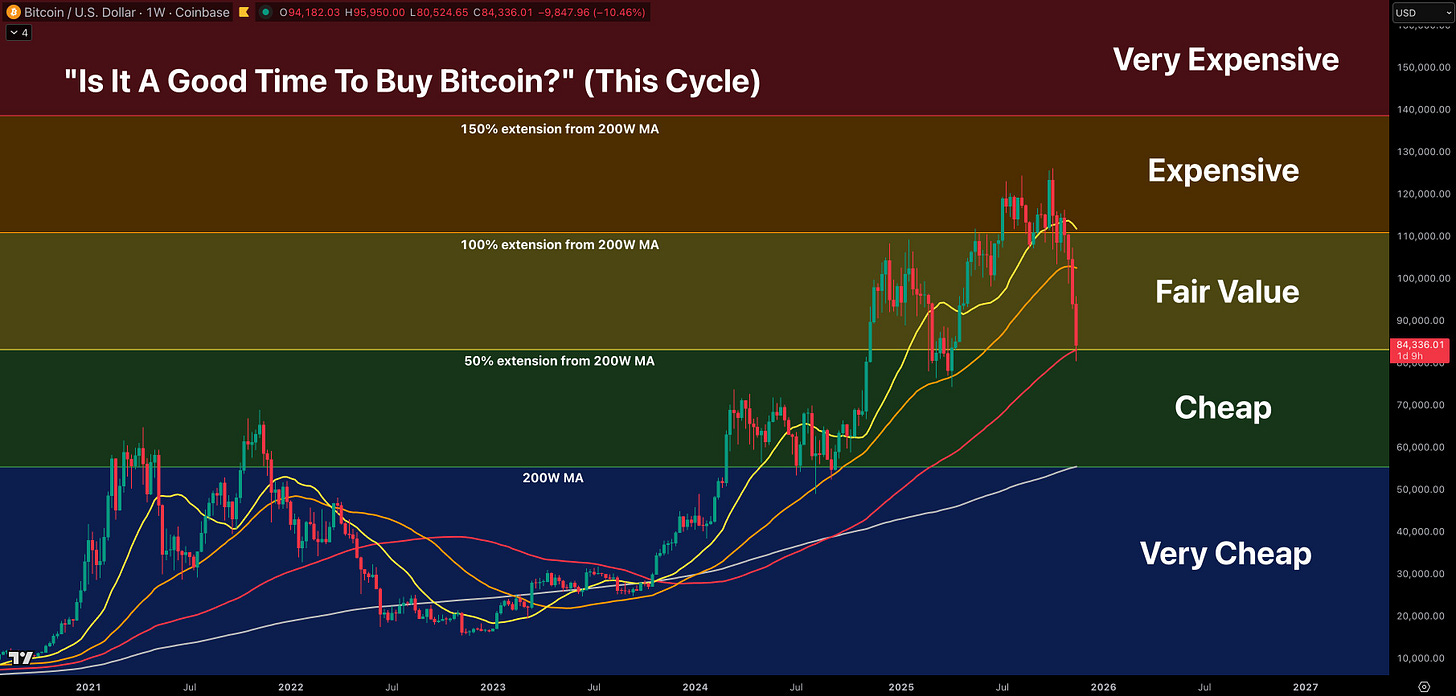

• BTC re-entered the Fair Value Zone

Historically a strong reset area during bull markets.

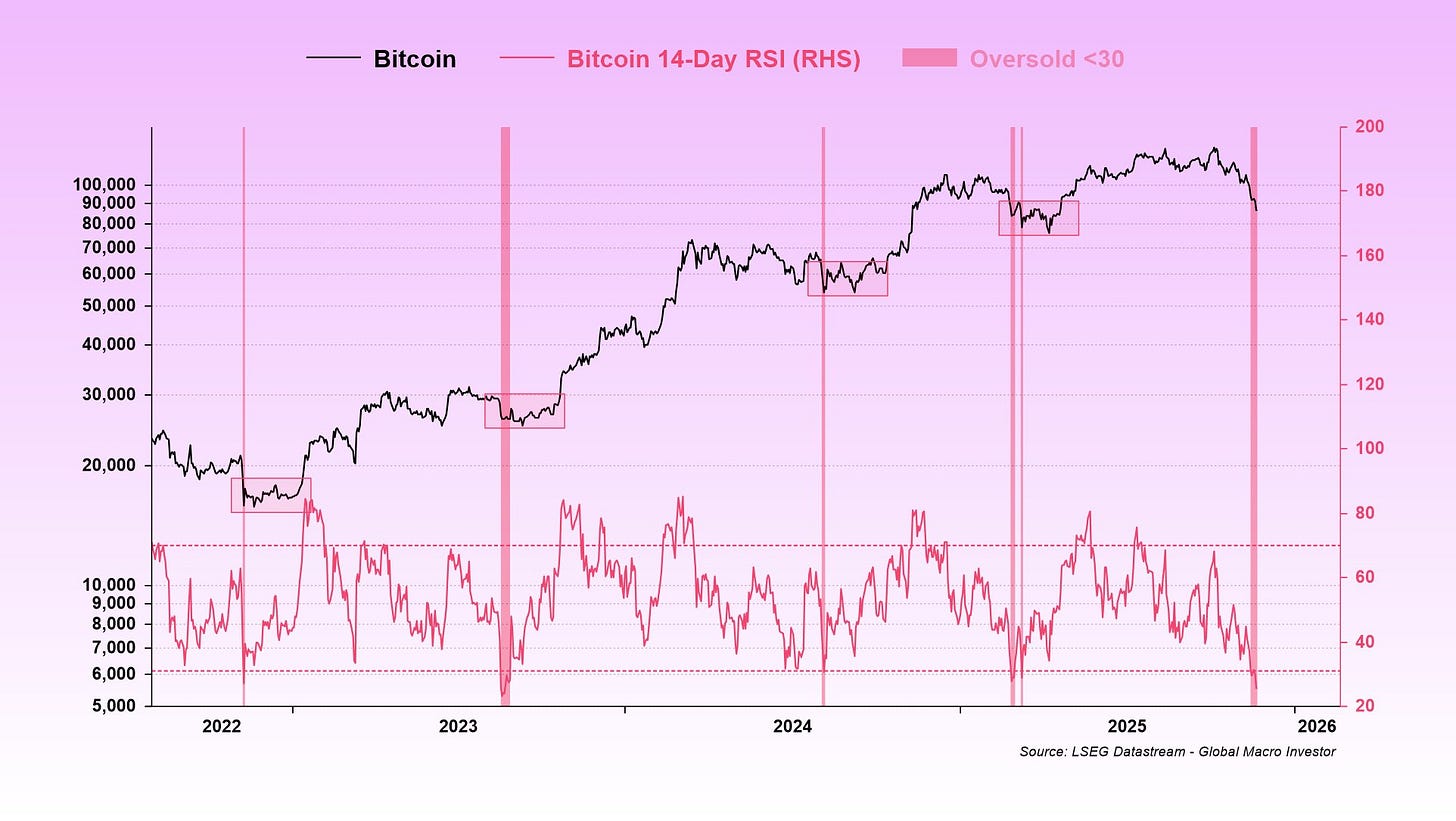

• RSI is extremely oversold

Both the daily and 14-Day RSI is at the same levels that signaled local bottoms throughout this bull market.

These oversold conditions plus upcoming liquidity shifts give Bitcoin a real shot at reversal — and altcoins would follow.

💧 Liquidity Tailwinds Are Building

Here are the major catalysts approaching:

1️⃣ QT Ends December 1st

The Fed officially ends Quantitative Tightening on Dec 1.

It doesn’t mean QE starts immediately, but it puts us on the runway for money printing.

2️⃣ Rate Cut Expected in December

Economic data continues to soften. If the Fed cuts again:

Capital becomes cheaper

Investors take more risk

Markets breathe again

Not a huge driver by itself — but a tailwind.

3️⃣ Global Liquidity Is Ramping Up

This past week Japan approved a $135.5 billion stimulus package.

Other nations are preparing their own money injections. This is bullish for all risk assets.

4️⃣ Bitcoin Dominance Has NOT Broken Down

At previous cycle tops, dominance collapsed violently. Altcoins have not experienced a true parabolic rally to new all time highs with retail participation and euphoria.

⚠️ The Big Unknown: Relief Rally or New ATHs?

While a reversal looks likely, here’s the truth:

We don’t yet know if the next move is…

A relief rally that fades into a bear market

orThe start of a run to new all-time highs

The charts show serious bearish signals.

The macro shows powerful bullish forces.

I’m still in the bullish camp, but I’ll be honest — the recent action has lowered my confidence. The next 3 months are absolutely critical.

We need to see:

Strength from Bitcoin

A rebound in the stock market

Liquidity confirming the macro bull thesis

If those line up, we still have a shot at the euphoric blowoff top we’ve historically seen.

🕰️ This Cycle Is Different — Timeline Extended to 2026?

The tariff shock reshaped the cycle.

We could now see this bull market extend into Q1–Q2 2026.

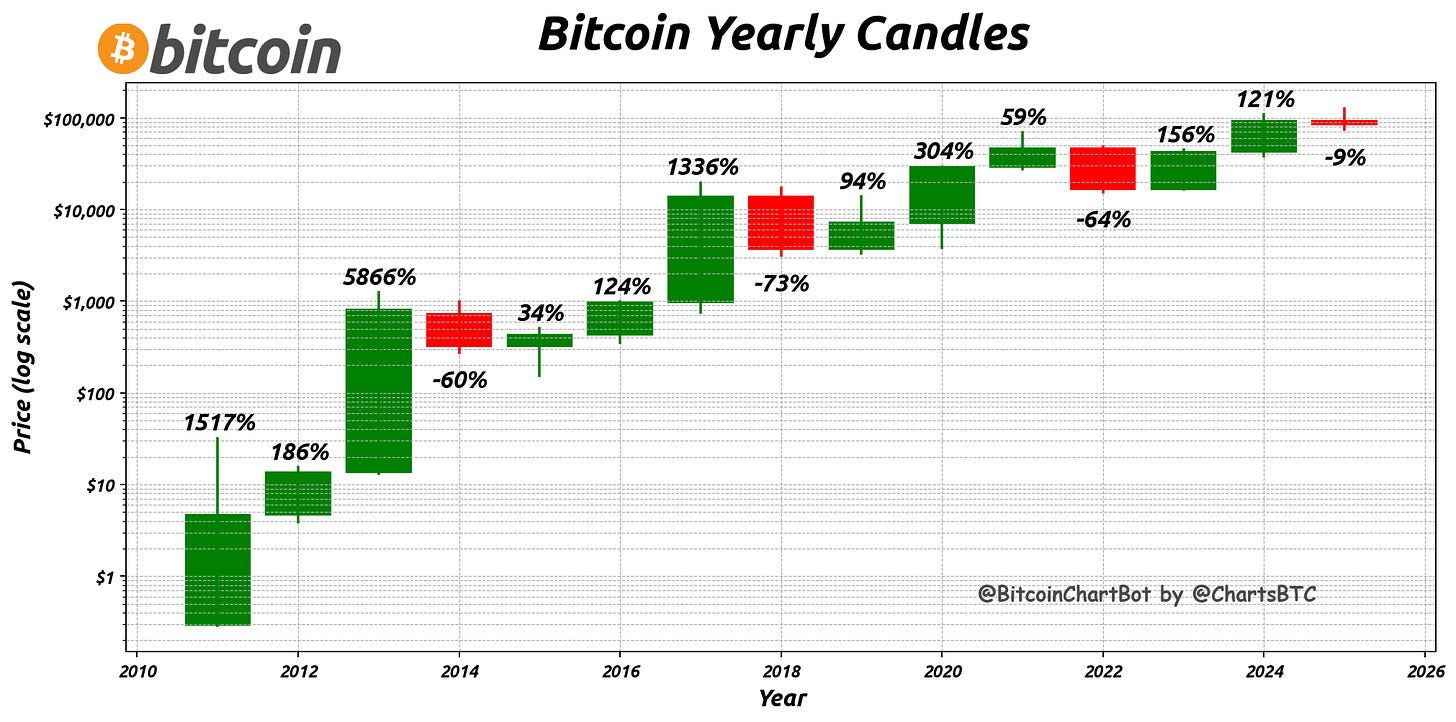

Look at Bitcoin’s yearly candles:

Historically: 3 green → 1 red

2025 is currently red, breaking the rhythm

This could change by December, but it’s clear this cycle is not following the traditional pattern.

If this bull market topped in fear rather than euphoria, that would be unprecedented.

🌅 Despite Short-Term Pain, The Macro Thesis Remains

Despite what’s happening in the short and mid term, my macro thesis hasn’t changed:

As long as central banks keep printing money, risk assets rise.

Fiat debasement drives asset appreciation

Liquidity cycles dominate everything

Bitcoin remains the best-performing asset in every QE era

We’ve hit a nasty bump — but nothing about the long-term foundation has changed.

Stay patient. Stay strategic.

The macro engine behind this bull market is still very much alive.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms. Get an exclusive $100 funding bonus!

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

SEC Commissioner Hester Peirce joined me to discuss the SEC’s new approach toward the crypto asset class and its latest guidance on various aspects of the market.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony

Interesting read

Tony I suggest to listen to Tom Lee’s interview on CNBC he explains what happened on 10/10/25. A market maker blew up after the $19 billion liquidation. They had to fill a large money hole so they had sell. A must watch a great learning event for me.