Is the Next Major Rally Loading?🤔

The charts, the whales, and the Fed all signal one thing — the bull market isn’t done yet.

Hey Thinkers 💡

The market chop continues, but positive signs are emerging — and it feels like we’re setting up for a major rally. Of course, nothing is guaranteed, but multiple signals point to a high probability that the next big move is up. Let’s dig in 👇

📊 Bitcoin Technicals Flash Bullish Setup

Bitcoin is currently retesting the highs from December 2024 and using them as support on the weekly chart. This is a classic move: testing previous resistance as new support before the next leg higher.

Daily Chart: The RSI shows plenty of room for upside, and the MACD is about to flip bullish. Also, BTC is now back above the 200-day moving average, which is the bull market line in the sand.

Monthly Chart: The MACD remains bullish, confirming that the macro uptrend is still intact.

The pattern is clear — this is a textbook consolidation before continuation.

🌍 Macro Trends Fuel the Bull Market

The macro bull market is still in progress across all major assets. Gold recently cooled off after a massive run to new highs, which could be either a local top or a blowoff top — either way, it suggests liquidity rotation into stocks and crypto.

Meanwhile, the S&P 500 just hit a new all-time high today, and history shows when equities run, crypto isn’t far behind.

We’ve seen this story before — everything is following global liquidity, and the data suggests there’s still more upside ahead.

🐋 Whales Keep Accumulating

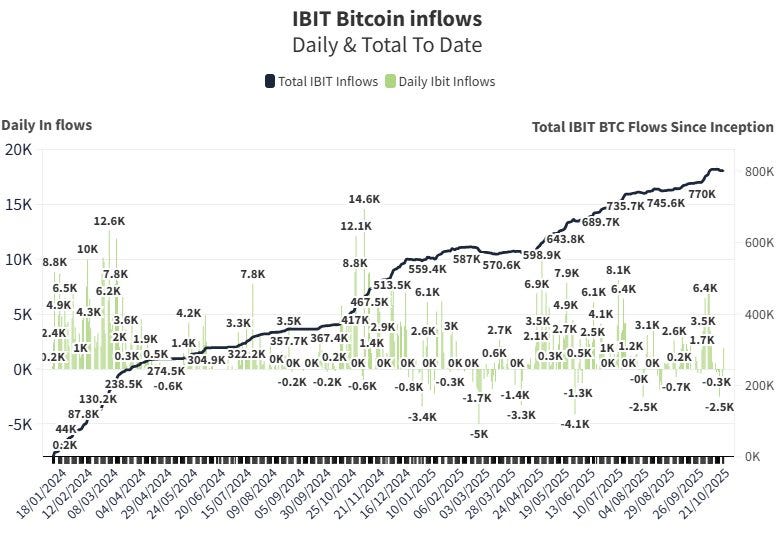

Even with recent outflows and market chop, Bitcoin whales aren’t slowing down.

BlackRock’s Bitcoin ETF added 976 BTC yesterday, bringing its total holdings to 804,900 BTC.

Institutional buying continues as smart money positions for the next phase of the bull market.

🏦 Macro Catalysts on the Horizon

Several major catalysts could ignite the next rally:

🏛️ Fed rate cuts expected soon

🔄 End of Quantitative Tightening (QT) hinted by Jerome Powell last week — paving the way for Quantitative Easing (QE)

🤝 Trump–China tariff resolution talks progressing

🇺🇸 U.S. Government reopening stabilizing markets

⚖️ CLARITY Act (Crypto Market Structure Bill) likely to pass the Senate

📈 SEC approval of altcoin ETFs anticipated

Each of these has the potential to inject massive liquidity and confidence into markets — and crypto stands to benefit most.

🔥 Major Crypto News

🏦 JPMorgan Opens the Door to Crypto Collateral

Bloomberg reports that JPMorgan Chase will allow institutional clients to use Bitcoin and Ethereum as collateral for loans by year-end. Tokens will be held by a third-party custodian, expanding on the bank’s earlier acceptance of crypto-linked ETFs as collateral.

➡️ Another sign of capitulation from traditional finance skeptics like Jamie Dimon.

💬 Fed Governor Embraces Crypto Innovation

Federal Reserve Governor Christopher Waller kicked off the central bank’s first-ever payments innovation conference this week, highlighting the arrival of crypto technology.

Waller even proposed a new framework for limited “master accounts” — potentially allowing crypto firms partial access to the Fed’s payment infrastructure.

➡️ Huge step toward integrating crypto into the U.S. financial plumbing.

🇬🇧 UK Opens Retail Access to Bitcoin & Ethereum ETPs

21Shares, Bitwise, and WisdomTree have made their Bitcoin and Ethereum ETPs available to retail investors in the UK.

Even BlackRock listed its Bitcoin ETP on the London Stock Exchange this week — following the UK regulator’s move to lift a four-year ban on retail crypto ETNs.

➡️ The UK joins the U.S. and Hong Kong in officially embracing regulated crypto investment products.

🧭 Final Thoughts

The charts, on-chain data, and macro environment all tell the same story: accumulation, patience, and positioning. The setup is aligning for what could be the next major leg of this bull market — and those who stay focused will be ready when it breaks.

Stay strong, stay informed, and keep thinking crypto 💪___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms. Get an exclusive $100 funding bonus!

___________________________________________

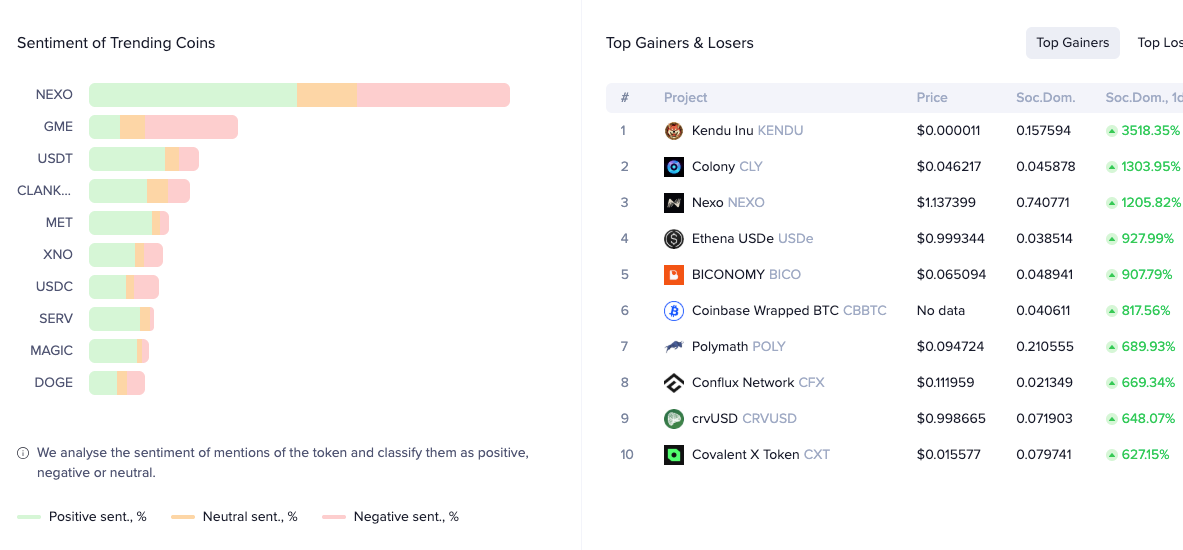

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

Kevin Lehtiniitty, CEO of Borderless XYZ, joined me to discuss their new Benchmark tool, which brings traditional market infrastructure logic—such as benchmarks and mid-market references—to the stablecoin economy.

Brandon Mulvihill, Co-Founder and CEO of Crossover Markets, joined me to discuss how the company is helping institutions trade crypto more efficiently.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony