Institutional Crypto Adoption Surges!🌊

Over the past week, we’ve seen a wave of crypto adoption and regulatory clarity like never before.

Hey Thinkers 💡

Despite the crypto market being stuck in a boring — and at times painful — consolidation, something much bigger is happening under the surface.

While prices chop, institutional adoption is accelerating and regulatory clarity is finally arriving. This is exactly what late-cycle and pre-expansion phases often look like: quiet markets, loud fundamentals.

Let’s break it down.

🏦 U.S. Regulators Open the Banking Door to Crypto

In a major step toward integrating digital assets into the traditional financial system, the Office of the Comptroller of the Currency (OCC) has issued conditional approvals that fundamentally change the landscape.

New National Trust Bank Approvals

Ripple and Circle received conditional approval to establish national trust banks

BitGo, Paxos, and Fidelity Digital Assets were approved to convert state trust charters into national charters, allowing nationwide operations

This is not symbolic — it places crypto-native firms directly inside the U.S. banking framework.

Riskless Principal Trading Clarified

The OCC also clarified in Interpretive Letter 1188 that national banks may engage in “riskless principal” crypto transactions.

In simple terms:

Banks can intermediate crypto trades

Buy from one client and sell to another simultaneously

Hold no crypto inventory

Function like regulated brokers

This removes one of the last major barriers for banks offering crypto trading.

🏛️ JPMorgan Goes Onchain — Big Time

JPMorgan continues to push real-world finance onto public blockchains.

Commercial Paper on Solana

JPMorgan arranged a commercial paper issuance on Solana, settled using USDC.

This marks one of the most significant real-world financial instruments ever deployed on a public blockchain.

Tokenized Money Market Fund on Ethereum

JPMorgan is also launching its first tokenized money-market fund on Ethereum:

My OnChain Net Yield Fund (MONY)

$100 million initial investment

First GSIB (Global Systemically Important Bank) to launch a tokenized fund on a public chain

This isn’t experimentation anymore — it’s production.

🧾 DTCC Gets Green Light for Tokenization

The DTCC’s depository subsidiary received an SEC No-Action Letter allowing it to tokenize certain DTC-custodied assets on approved blockchains.

What’s Coming (H2 2026):

Russell 1000 equities

Major index ETFs

U.S. Treasuries

These tokenized assets will carry:

Full ownership rights

Investor protections

Identical entitlements to traditional securities

This is a massive unlock for capital markets.

🚀 Figure Plans IPO Shares Issued on Solana

In a move that could redefine public markets, Figure Technologies is preparing to file a second IPO application — with a twist:

Shares issued natively on Solana

If approved, this could:

Reduce settlement times

Increase transparency

Lower issuance costs

And most importantly…

👉 Open the door for other companies to follow.

🎥 YouTube & PayPal Bring Stablecoins to Creators

YouTube has enabled U.S. creators to receive payouts in PayPal’s PYUSD stablecoin.

According to PayPal’s head of crypto, May Zabaneh:

“The beauty of what we’ve built is that YouTube doesn’t have to touch crypto.”

Key details:

PYUSD payouts launched in Q3 2025

Currently available only to U.S. creators

Simplifies stablecoin adoption without friction

This is how crypto scales — invisibly.

💼 Interactive Brokers Embraces Stablecoins

Interactive Brokers will now allow retail investors to fund brokerage accounts using stablecoins, according to Bloomberg.

This move keeps them competitive and signals that stablecoins are becoming a standard financial rail.

🔮 Looking Ahead to 2026

As we head into 2026:

Institutions are building

Regulators are clarifying

Tokenization is accelerating

And the crypto market structure bill is expected to pass in Q1–Q2 2026, unlocking the next phase of adoption.

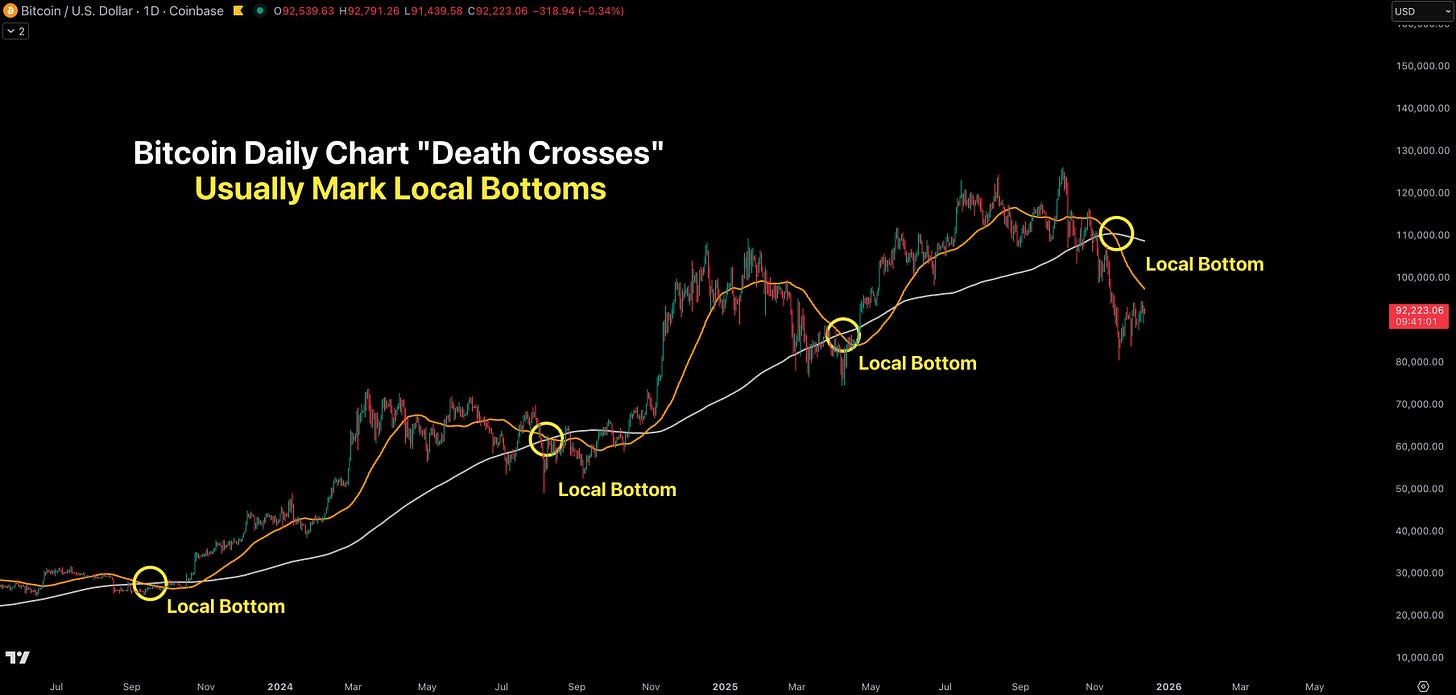

⏳ When Will Bitcoin and Altcoins Rally?

Patience remains the key.

As we’ve discussed in recent newsletters, a rally is coming — but the question remains:

Relief rally… or bull market continuation?

We’ll have to let price action decide.

Here’s what I’m watching closely:

QE “Lite” began on December 12th

Liquidity should start hitting markets in January and February

Bitcoin whales have slowly resumed accumulation — a constructive signal

Price will follow liquidity. It always does.

🧩 Final Thoughts

The market may feel dull right now, but the foundations of the next major move are being laid in plain sight.

Crypto is no longer knocking on the door of traditional finance — it’s being invited inside.

Stay patient. Stay informed.

The quiet periods are where the biggest opportunities are born.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms. Get an exclusive $100 funding bonus!

___________________________________________

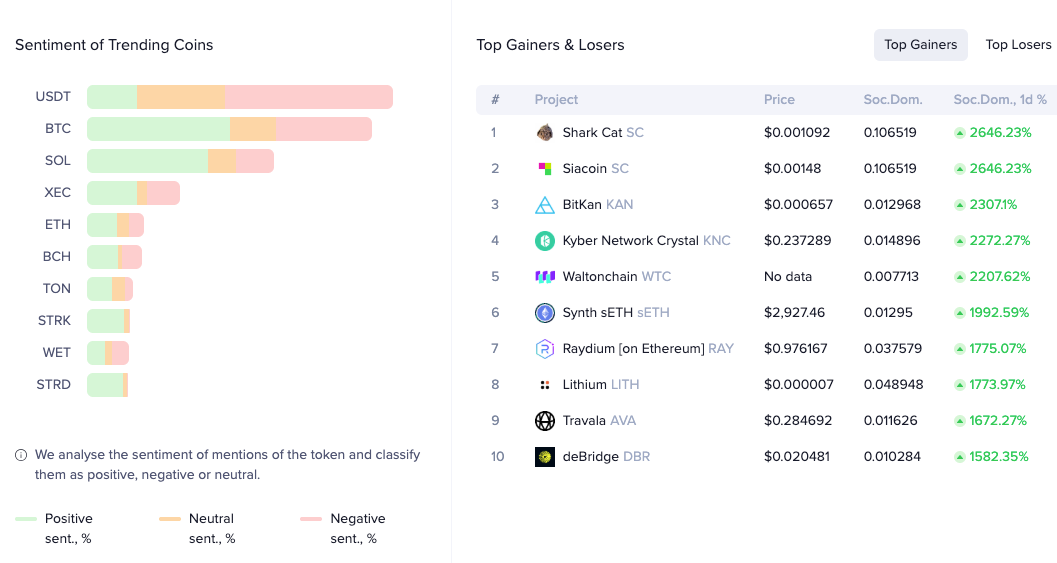

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

Matej Zak, CEO of Trezor, and I sat down at their Prague office to discuss the new Trezor Safe 7 hardware wallet and much more.

Keith Grossman, President at MoonPay, joined me to discuss how the firm is unlocking crypto access for both retail and institutional users.

Dan Silverman, Co-CEO and Co-Founder of Balcony, joined me to discuss how the firm is tokenizing billions in real estate on the Avalanche blockchain.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony

Thanks for the info Tony!

2026 is going to be hot. Keep up the great work Tony.