Historic Week For Bitcoin! 🚀

US States are setting up their Bitcoin Reserves and BTC's price is on the rise.

Hey Thinkers 💡

What a week for Bitcoin!

We just witnessed two U.S. states officially pass Bitcoin Reserve Bills into law — and BTC has surged past $101,000 at the time of writing. The momentum is undeniable.

🏛️ U.S. States Embrace Bitcoin

New Hampshire made history as the first state to pass a Bitcoin Reserve Bill into law — and Arizona quickly followed suit. This marks a pivotal moment in Bitcoin’s journey as U.S. states take the lead, even ahead of the federal government.

While President Trump recently signed an Executive Order to create a Strategic Bitcoin Reserve, these state-level moves show game theory in action. The first domino has fallen, and now it’s easier for others to follow. In game theory, no one wants to be last, especially when it comes to adopting a high-performing asset like Bitcoin.

This is more than just symbolic. It shows growing recognition across different levels of government and society that Bitcoin is a legitimate asset class — one offering superior returns compared to traditional assets. Expect more states to join in, pushing Congress toward broader federal adoption of a Bitcoin Reserve.

🎙️ This week, I sat down with Dennis Porter, CEO of the Satoshi Act Fund, who has been instrumental in helping states set up their Bitcoin reserves. Watch the full interview for a behind-the-scenes look at how these wins were achieved.

🏢 Institutions Keep Stacking Bitcoin

Meanwhile, the institutional adoption train keeps rolling.

Strive Asset Management, founded by Vivek Ramaswamy, is going public through a merger with NASDAQ-listed Asset Entities. The goal? To become a public Bitcoin Treasury Company with a $1 billion capital target.

Jack Mallers’ Strike is also expanding — announcing plans to launch BTC-backed lending, allowing users to borrow fiat while holding their Bitcoin.

These moves show that not only are governments embracing Bitcoin, but major financial players are building strategies around it.

📈 Bitcoin’s Bullish Setup Is Playing Out

For months, I’ve shared signals pointing to a major bull run. With Bitcoin now over $100K, that thesis is playing out beautifully.

Here’s what I’m watching:

✅ Bitcoin on the daily: Holding strong above the 200-day Moving Average — a key indicator that we’re in bull market territory.

✅ Weekly charts: Extremely bullish. The RSI has broken out, and the MACD is close to flipping green.

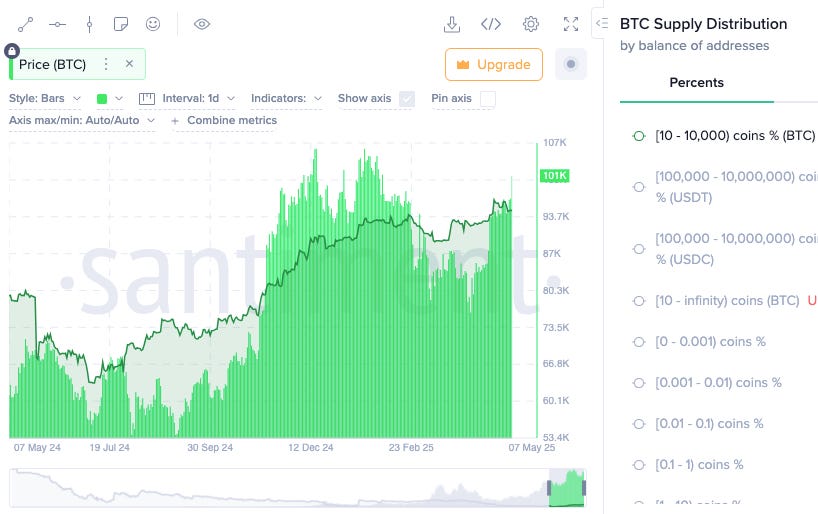

✅ Whale accumulation: Santiment data shows a continued rise in wallets holding 10+ BTC.

✅ Global liquidity: On the rise — and Bitcoin is following suit.

⚠️ Short-term caution: BTC could face resistance at $102K, which may result in a brief pullback. But my current target for Q2 remains $120K–$121K, assuming market conditions remain favorable. As always, nothing is guaranteed — but the probability for continuation looks strong.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

Brian Foster, Global Head of Wholesale at Coinbase Institutional, joined me to discuss how institutions are embracing the crypto asset class.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony