Get Ready! The Money Printer Will Start Soon! 💵

The Fed says it will begin purchasing US Treasury Bills on December 12th and will purchase $40 billion worth of Treasury Bills in 30 days.

Hey Thinkers 💡

Momentum is building — fast.

Today we heard from Fed Chair Jerome Powell, and as expected, the Fed cut interest rates by 25 bps, making capital cheaper and more accessible.

But the big news isn’t the rate cut…

The real story: The Fed begins buying U.S. Treasury Bills on December 12th — $40 BILLION worth in 30 days.

This marks the official start of QE Lite, the early phase of the money-printing cycle.

As we’ve been discussing for a while, once QT ended on December 1st, the Fed would tee up Quantitative Easing.

This isn’t full-on QE yet, but it’s the beginning of the turn.

As James Lavish put it:

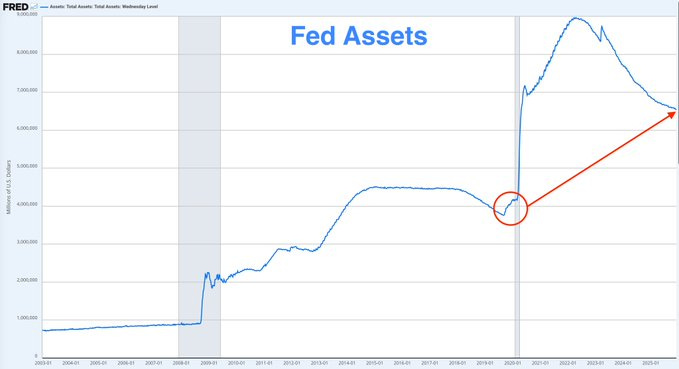

“Here we go again. The Fed just announced that it will buy $40B of Treasury Bills in the next 30 days.

If you’re wondering where this puts us in the ‘printing cycle,’ it is right here.”

Liquidity is the lifeblood of markets — and it’s finally coming back. The U.S. isn’t alone. Other central banks are stimulating their economies as well. Most recently, Japan announced a large stimulus package, adding even more fuel to global liquidity.

This environment bodes extremely well for risk assets!

📈 Bitcoin Charts & On-Chain Data Turning Bullish

BTC Price Action

Bitcoin moved over $94,000 yesterday — a strong sign of momentum shifting.

We’re now seeing:

Higher highs and higher lows forming

The daily MACD flipping bullish

The RSI showing plenty of room before overbought

This is exactly the type of structural recovery we want to see.

Stock Market Confirmation Needed

The S&P 500 and Russell 2000 are showing early strength, but not enough to confirm the next major leg up just yet.

Crypto rarely decouples for long — stocks will matter here.

Whales Are Back

After nearly 2 months of distribution, on-chain data from Santiment shows:

Bitcoin whales holding 10+ BTC are accumulating again.

This is one of the strongest bullish signals we can get.

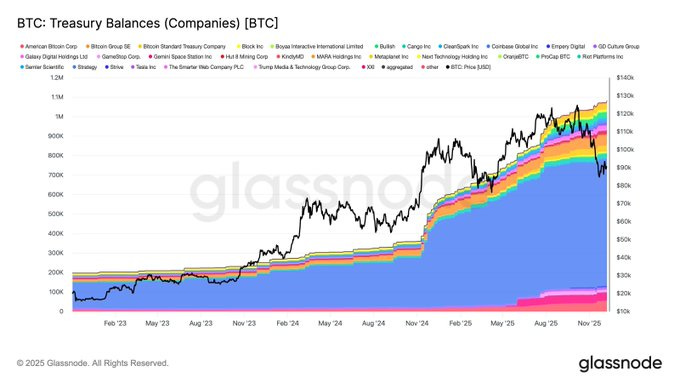

Corporate Bitcoin Holdings Are Surging

Digital asset treasury companies continue buying BTC and ETH despite the downturn.

Corporate Bitcoin holdings:

197K BTC → 1.08M BTC since Jan 2023

+448% increase

(Glassnode)

Institutions are not selling. They’re preparing for what’s coming.

🔮 Catalysts Setting Up a Major 2026 Rally

Here are the macro forces that could ignite a powerful bull cycle into 2026:

🟢 1. QE from the Fed & Global Central Banks

Liquidity rising globally = risk assets rise globally.

🟢 2. Lower Rates = Cheap Capital

Lower rates push investors out of money market funds and into higher-return assets like crypto.

🟢 3. U.S. Crypto Market Structure Bill (CLARITY ACT)

Expected to be passed Q1–Q2 2026.

The biggest regulatory unlock since the ETF approvals.

🟢 4. Crypto & Tech IPO Boom

A wave of IPOs are coming:

Crypto companies

Blockchain infrastructure providers

AI giants

Companies don’t go public in bear markets.

This is a bull signal.

🟢 5. Trump Will Appoint a New Fed Chair

Powell’s tenure ends May 2026.

Trump will appoint someone aligned with his economic goals — meaning:

Lower rates

Market-friendly policy

Possibly full-scale QE

All of this supports risk assets.

⚠️ But We Must Prepare for Multiple Scenarios

Analyst CryptoCurrently produced a great chart outlining the possible Bitcoin paths from here.

Even with the bullish macro backdrop, it’s possible that:

The current move is just a relief rally

BTC fails to make new highs

Altcoins outperform but without a euphoric blowoff top

I’m not saying this will happen — but we must acknowledge the possibility.

Markets don’t owe us certainty.

🔥 Major Crypto News

1️⃣ OCC Opens the Door for Banks to Offer Crypto Brokerage

The U.S. Office of the Comptroller of the Currency (OCC) announced that national banks can intermediate crypto trades as riskless principals — without holding the assets on their balance sheets.

This mirrors traditional brokerage activity and brings banks one step closer to offering fully regulated crypto trading services.

Massive development.

2️⃣ PNC Private Bank Enables Bitcoin Trading

PNC clients can now:

Buy

Sell

Hold

Bitcoin directly within their existing accounts via Coinbase’s Crypto-as-a-Service platform.

This is the first major U.S. bank to roll out such an offering.

3️⃣ CFTC Allows BTC, ETH & USDC as Collateral

The CFTC has launched a pilot program enabling:

BTC

ETH

USDC

to be used as collateral in U.S. derivatives markets.

This comes with strict oversight and updated tokenized asset guidance following the GENIUS Act.

Institutional rails continue to expand.

4️⃣ French Banking Giant BPCE Opens Crypto Trading to Millions

BPCE — through Banque Populaire and Caisse d’Épargne — will offer crypto trading to 2 million users, expanding to 12 million by 2026.

Assets supported:

BTC

ETH

SOL

USDC

Fees:

€2.99 per month

1.5% transaction fee

Another European giant entering the arena.

🧩 Final Thoughts

Momentum is clearly shifting.

Rate cuts ✔️

QE Lite starting ✔️

Global liquidity rising ✔️

Bitcoin momentum returning ✔️

Whales accumulating ✔️

Institutions buying ✔️

The next few months will determine whether this is:

The beginning of a new all-time-high run, or

A relief rally before deeper consolidation

Stay focused. Stay disciplined.

Massive opportunities lie ahead — but so does volatility.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms. Get an exclusive $100 funding bonus!

___________________________________________

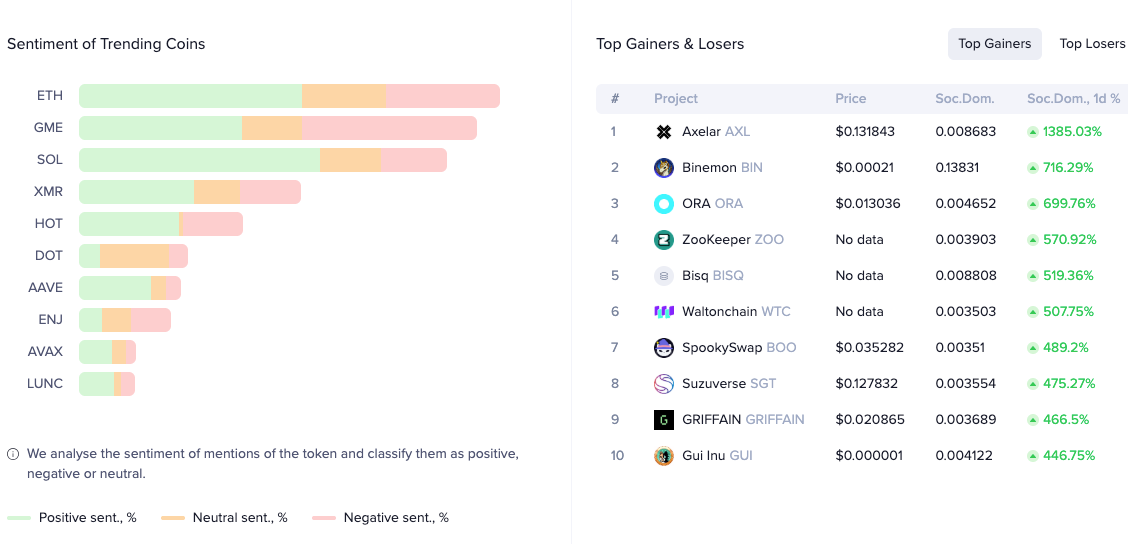

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

Keith Grossman, President at MoonPay, joined me to discuss how the firm is unlocking crypto access for both retail and institutional users.

Dan Silverman, Co-CEO and Co-Founder of Balcony, joined me to discuss how the firm is tokenizing billions in real estate on the Avalanche blockchain.

Matt Hougan, CIO at Bitwise Asset Management, joined me to discuss the launch of their XRP, Solana, and Dogecoin Spot ETFs.

___________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony

The print is "just starting". Oh it's going to get good!

https://open.substack.com/pub/bulloffreedommoney/p/a-wave-of-new-liquidity?r=6qve3e&utm_medium=ios&shareImageVariant=overlay