🚨 Fed To Cut Rates & Pump Markets!🚀

Jerome Powell gives the signal that QT is over and rate cuts are coming soon.

Hey Thinkers 💡

Market Update: Fed Chair Jerome Powell Hints at Interest Rate Cuts

Today, at the annual Jackson Hole Symposium in Wyoming, Federal Reserve Chair Jerome Powell declared, "The time has come" for the Fed to cut interest rates. Although Powell refrained from specifying when these cuts would begin or the extent of them, the Federal Reserve is widely anticipated to announce a modest quarter-point reduction in its benchmark rate during its mid-September meeting.

What Does This Mean for the Economy and Markets?

We are on the cusp of a significant shift in the economic cycle, transitioning from the Bust Cycle to the Boom Cycle. This change signals the end of Quantitative Tightening (QT) and a return to the more accommodative monetary policy of Quantitative Easing (QE). With cheaper capital and an increase in the money supply, we can expect a rise in asset prices, which is particularly bullish for both cryptocurrencies and stocks. Moreover, this development bodes well for the broader business cycle.

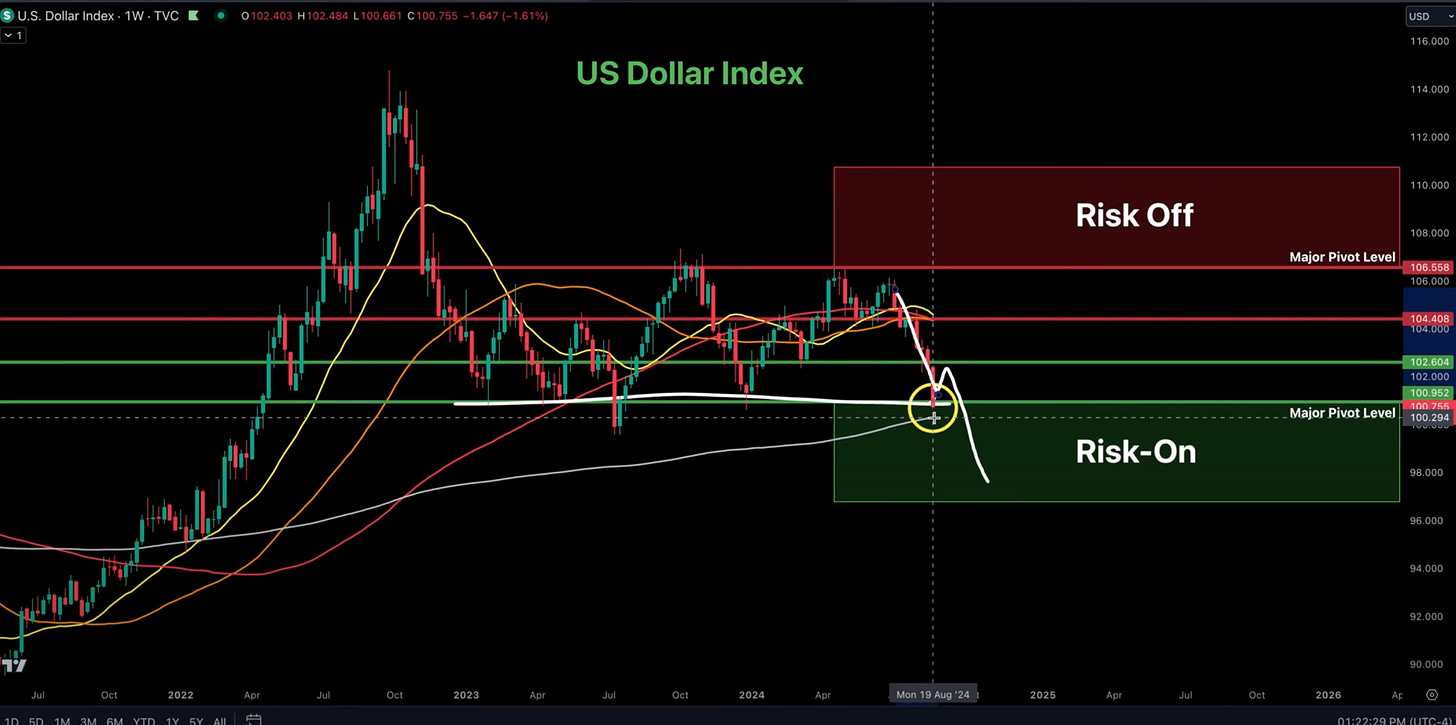

With rate cuts on the horizon in September, along with continued liquidity injections from Janet Yellen and the Treasury, we could soon witness a major rally in both crypto and stock markets. Following Powell's announcement today, the U.S. Dollar Index (DXY) continued its downward trend and seems poised to fall below 100 in the near future. This is a bullish signal for risk assets.

Now we do have to be patient, we won’t see an instant mega bull run, but a star step up from the lows we are currently in. I think by mid-September into early October markets will start to move significantly.

Market Implications: Expect a Crypto and Stock Rally

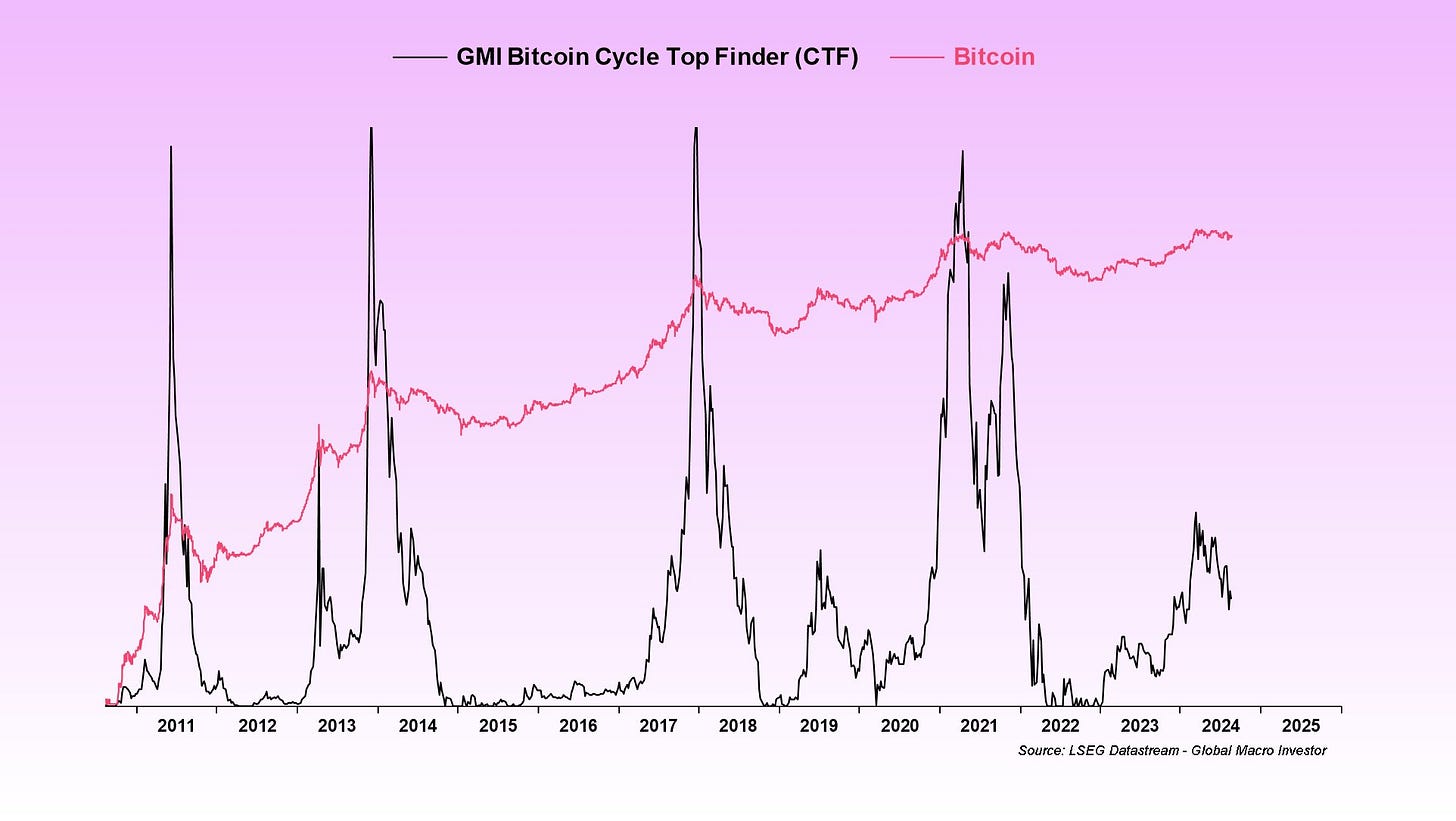

In the coming weeks, a significant number of short positions are likely to be closed, leading to liquidations over the next month. In the crypto market specifically, this could mark the 5th wave of the current bull market, where Bitcoin and altcoins might go parabolic. It's clear that we are not near the peak of this cycle yet. Below is an insightful chart from Julian Bittel that illustrates this trend.

Personal Strategy: Planning Ahead

On my end, I’m diligently reviewing my cash-out strategy for cryptocurrencies and stocks. This 5th wave could extend into Q1 2025, and it’s crucial to have a plan in place as the market could enter a euphoric phase, driven by extreme greed. This is the time to be cautious and consider taking profits. Remember Warren Buffett’s sage advice: "Be fearful when others are greedy, and be greedy when others are fearful."

___________________________________________

📰 Latest Crypto News:

Russia to launch two crypto exchanges and stablecoins linked to the Yuan and BRICS currency, Kommersant reports. - source

Sony Group teases launch of Ethereum Layer-2 blockchain with Startale Labs - source

Crypto exchange Kraken’s motion to dismiss US SEC case denied - source

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

BitGo is one of the top custodians in the crypto industry. They provide the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📈Crypto Market Metrics

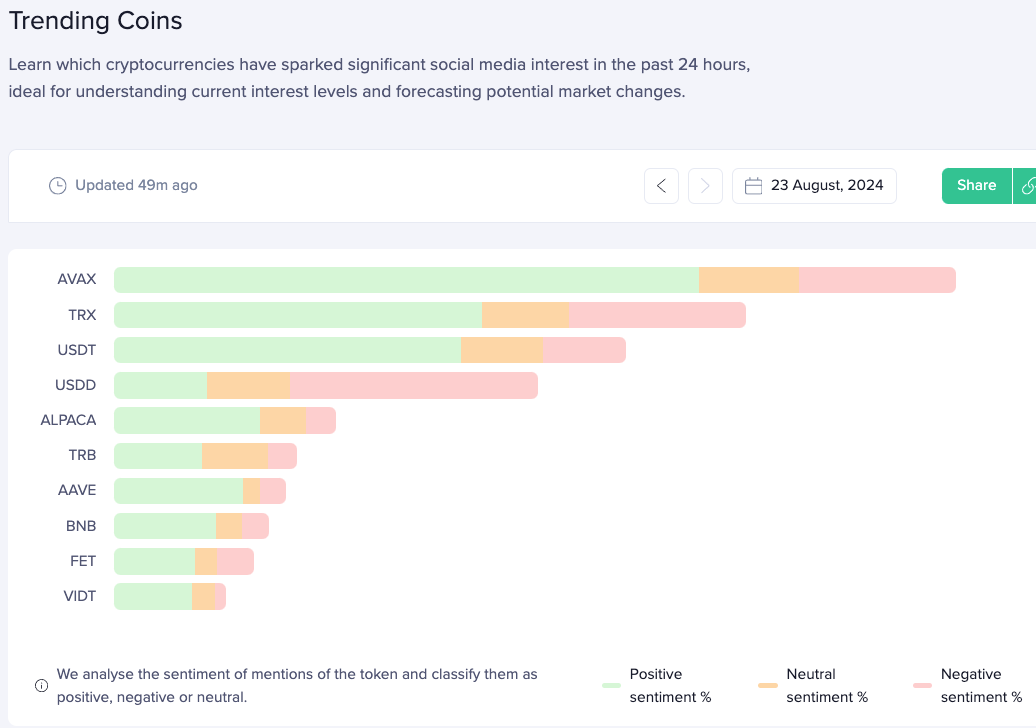

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Sheila Warren of the Crypto Council for Innovation discusses Crypto's impact on Democrats and Republicans and politics.

Reagan Cook of TaxBit discusses IRS Crypto rules, FASB Bitcoin balance sheet implications and more.

___________________________________________

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony