Don't Panic! QE is Coming!

Bitcoin and Altcoins are struggling based on market cycles and macro factors but all signs point to the return of QE

Hey Thinkers 💡

Macro Concerns, QE Expectations, and Crypto Whales

As we dive into the latest market trends, macroeconomic factors like Treasury yield curves, inflation, and the strengthening Dollar Currency Index (DXY) continue to dominate investor sentiment. These challenges are casting a shadow over both stock and crypto markets, leaving investors on edge about the potential direction of financial assets. However, there’s growing speculation that a significant shift could be on the horizon.

The Case for Quantitative Easing (QE)

The global financial environment is tightening:

Treasury Yield Curves: Long-term rates, like the 30-year, are pushing 5%, raising alarm bells as refinancing costs rise.

Liquidity Crunch: Global liquidity is retracting, and traditional buyers of U.S. Treasuries, such as China, Japan, and the Middle East, are showing less interest.

Reverse Repo Facility: Nearly drained, reducing another liquidity backstop for the Fed.

With limited tools at their disposal, the Federal Reserve may have no choice but to turn to Quantitative Easing. Bill Barhydt, CEO of Abra, highlighted on X that QE could begin as soon as early 2025, likely before March. The Fed’s aim? To lower long-term rates and stabilize the economy—though this may risk further weaponizing U.S. debt globally.

Barhydt predicts that QE could send long-term rates plummeting to 3.5% within 12 months, sparking a surge in risk-on assets. This could be the long-awaited catalyst for crypto’s next leg up. Picture Bitcoin at $200K, Solana at $500, and SUI at $20. While these projections aren’t financial advice, the sentiment is clear: QE could reignite a bull market.

Market Cycles & Projections

Bob Loukas, a respected market analyst, paints a cautious but optimistic picture for the broader market. His weekly S&P 500 chart suggests further downside in the short term, followed by a sharp upward trajectory starting late Q1 into Q2. Given crypto’s historical correlation with equities, Bitcoin is likely to follow a similar pattern.

Bullish Foundations in the Making

Several indicators hint at the groundwork being laid for the next phase of the bull run:

Market Sentiment: Bitcoin’s Fear and Greed Index has returned to neutral after an extended period of greed, resetting expectations. It could go to fear before the reversal in price.

Leverage: A flush-out of excessive leverage has created a more stable foundation.

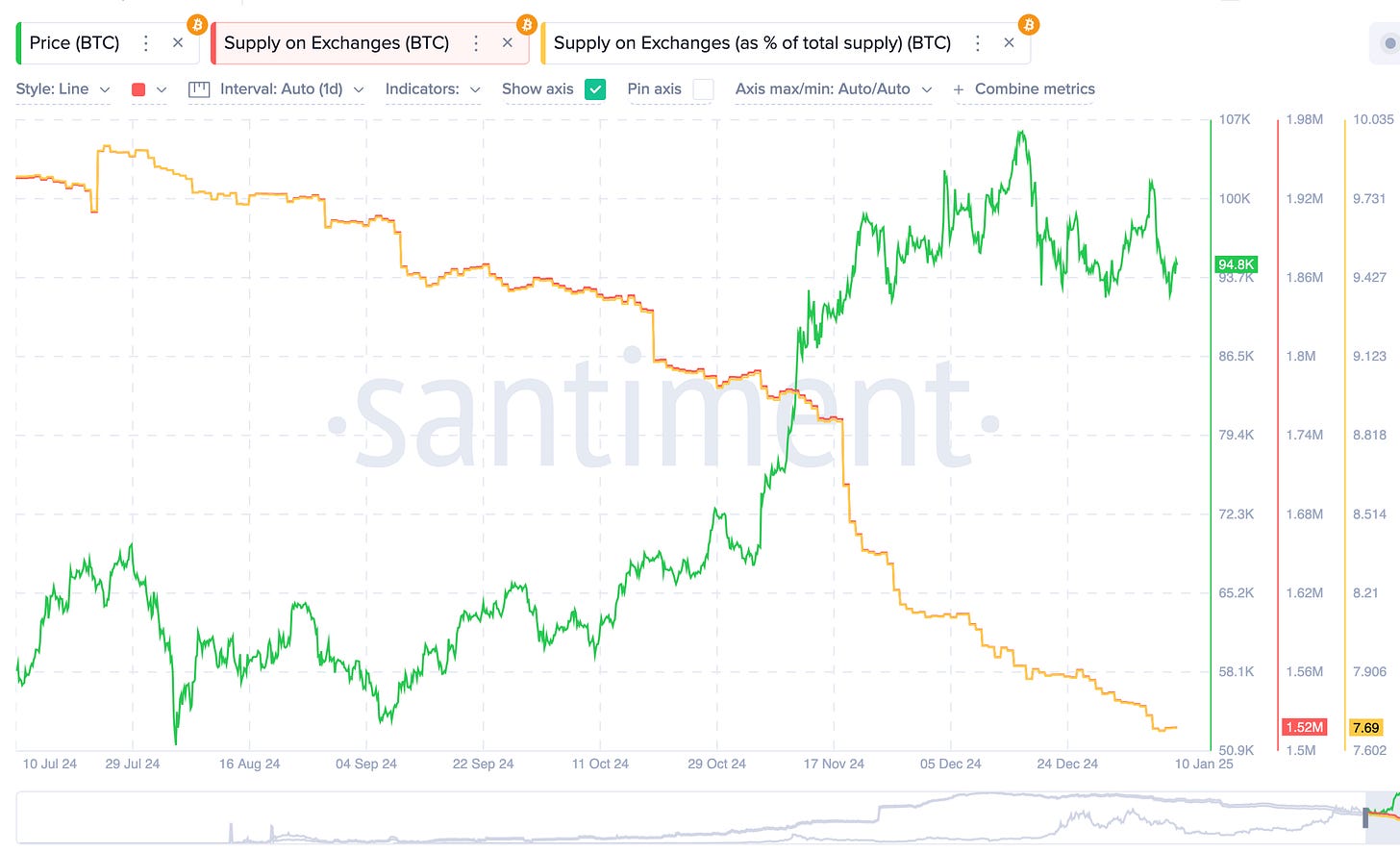

Bitcoin Supply Dynamics:

Whales Accumulating: Despite a recent slow down, addresses holding 10+ BTC are still adding to their balances, signaling confidence in the market’s long-term potential.

Declining Exchange Supply: Bitcoin on exchanges continues to drop, reducing sell-side pressure.

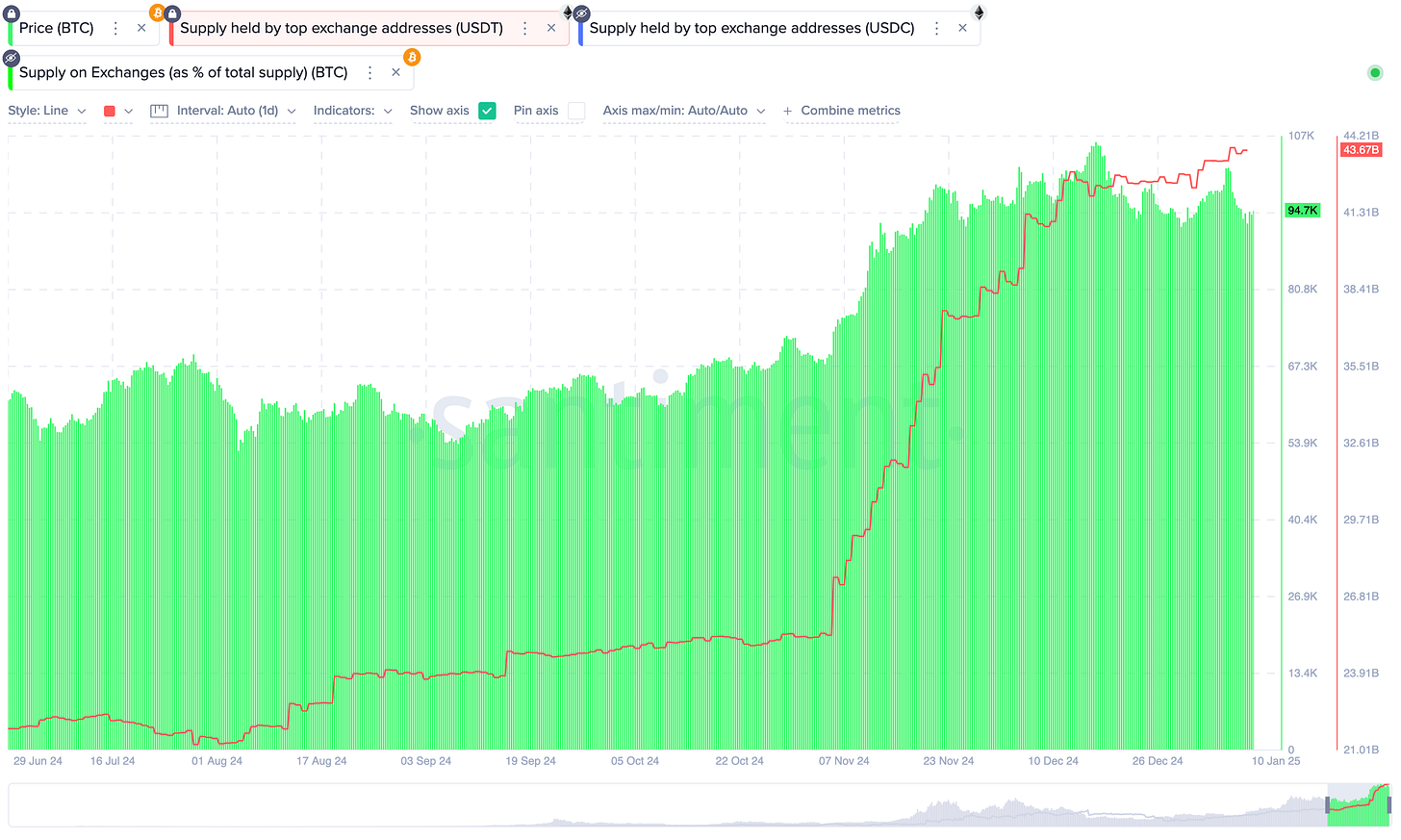

Stablecoin Liquidity: Tether (USDT) reserves are rising, hinting at readiness for significant buying activity.

What’s Next?

For now, markets remain volatile, with wide-ranging price action keeping both traders and hodlers on their toes. But as QE looms closer, the possibility of a robust altcoin season grows. This is a time for patience and strategic planning.

If Barhydt and Loukas are right, the next few months could bring unprecedented opportunities for both stock and crypto investors.

Action Items:

Keep an eye on Fed announcements for any QE hints.

Monitor whale activity and stablecoin movements for early buying signals.

Prepare for potential market turbulence before the eventual upswing.

Watch my interview with Brian Q. from Santiment as he breaks down the key metrics around Bitcoin and Altcoins in this pullback.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

BitGo is one of the top custodians in the crypto industry. They provide the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Franklin Bi is a General Partner at Crypto hedge Fund Pantera Capital. He previously worked at JPMorgan leading their Blockchain and Digital Assets strategy. We discuss Pantera’s 2025 investment strategy and more.

___________________________________________

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony

I am in the same camp as you. QE will reignite one last bullish move, before the collapse.