China's QE Will Pump Bitcoin!🚀

News broke that China will inject stimulus to boost economic growth, which is bullish for risk assets

China Takes Major Steps Towards Economic Stimulus

In a significant policy shift, China’s central bank has initiated quantitative easing (QE) measures to meet its economic growth targets and halt a downward spiral in the equity market. This strategic move comes as the CSI 300 Index—one of China's leading stock benchmarks—hit a more-than-five-year low earlier this month.

At a rare briefing, Pan Gongsheng, Governor of the People’s Bank of China (PBoC), outlined various stimulus measures designed to rejuvenate the economy. These include:

Allowing brokerages and funds to access central bank funding to purchase stocks, providing critical market support.

Enhancing banks' lending capabilities to consumers and corporations.

Reducing the key short-term interest rate to spur economic activity.

Jun Rong Yeap, a market strategist at IG Asia, commented, “Market participants may like what they see today... [This] could drive a short-term rebound in Chinese equities, dispelling previous concerns around the authorities’ inaction.”

What This Means for Global Markets and Bitcoin

China's QE comes amid a global trend of rising liquidity, which is viewed as bullish for risk assets like Bitcoin and other cryptocurrencies. With interest rate cuts occurring globally, including in the United States, many governments will inevitably return to printing more money to manage their national debt. The financial world is now leaving the quantitative tightening phase behind, signaling a new era of expansionary monetary policy.

For risk assets, including Bitcoin and Altcoins, this uptick in global liquidity can mean only one thing: a strong price surge. As more money flows into the system, investors turn to higher-risk assets for better returns.

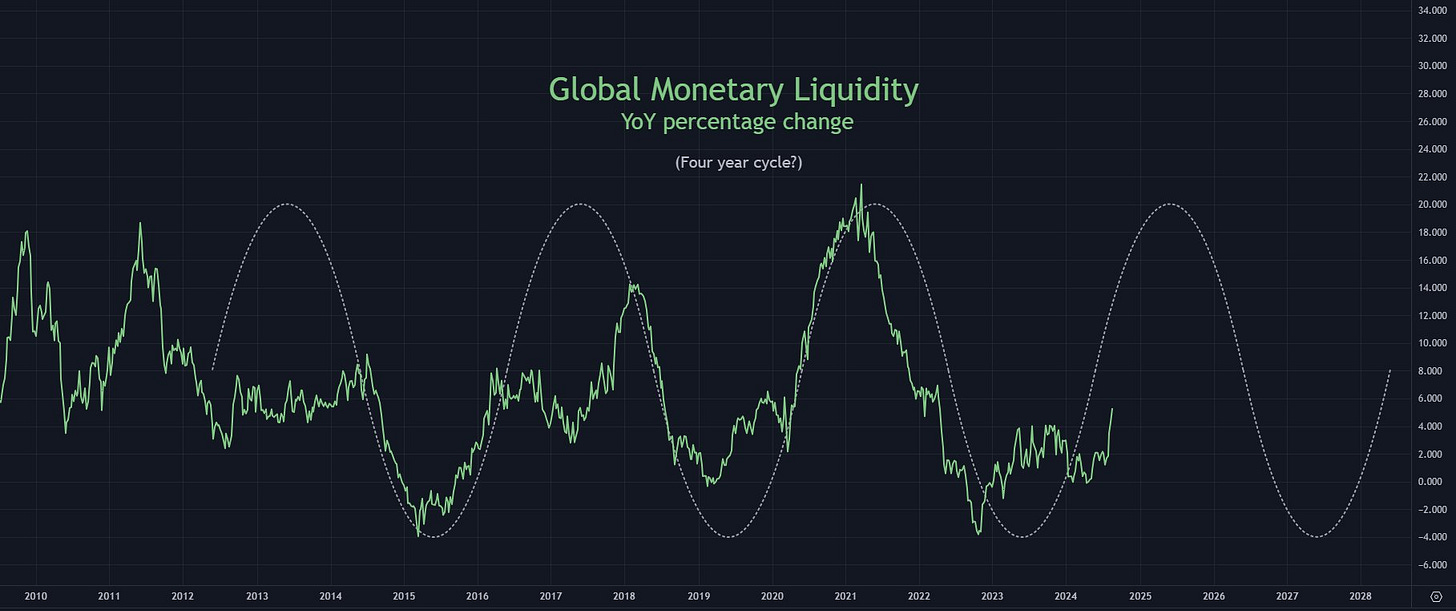

Chart Highlight: Global Liquidity Breakout

Global liquidity is breaking out, and the latest developments in China could accelerate this trend. While the effects of China's QE haven’t yet shown up on global liquidity charts, experts believe it will soon add fuel to the rally in risk assets.

What the Experts Are Saying:

Raoul Pal (Global Macro Investor) highlighted the importance of this shift, tweeting:

"I love the smell of MOAR COWBELL in the morning... The Everything Code is in full play and this is around the third innings... Remember - Markets lag Global liquidity by 10 weeks (new China stimulus doesn’t even appear on the chart yet, so this is prior to today’s announcement)."

Dan Tapiero (Founder, 10T Holdings) emphasized the significance of China’s decision:

"Huge macro event. Things are so bad in China, the government flinches. QE for China equity, rate cuts, big liquidity coming. Low likely in for China assets. Bazooka. Bullish on GOLD and BTC."

The Role of the Dollar:

As we watch global liquidity rise, a key indicator remains the U.S. Dollar Currency Index (DXY). With interest rate cuts in the U.S. on the horizon, the dollar is expected to weaken. Once the DXY drops below 100, it will likely trigger a "risk-on" sentiment among investors, pushing them further toward risk assets like Bitcoin, Altcoins, and other high-risk investments.

Conclusion:

China's bold move toward quantitative easing represents a pivotal moment for global markets, particularly for risk assets like Bitcoin. With global liquidity rising and rate cuts on the table worldwide, we are moving into a new, more accommodative monetary era. The potential for a major rally in cryptocurrencies, gold, and equities is on the horizon as central banks and governments alike shift focus toward economic expansion.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Gemini makes it easy to trade crypto with many unique features and prodcuts.

BitGo is one of the top custodians in the crypto industry. They provide the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📰 Latest Crypto News:

Kraken expands European footprint with acquisition of Dutch crypto broker BCM - source

CryptoQuant says bitcoin’s 'supply in profit' level signals potential for further gains - source

Hong Kong starts second phase of e-HKD pilot to explore tokenization, offline payments - source

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Analyst Credible Crypto provides bull market analysis and price predictions for Bitcoin, Ethereum, XRP, Solana, and Chainlink.

___________________________________________

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony