⚫️BlackRock's Bitcoin ETF Options Approved!

The SEC just approved options for IBIT, learn what this means for Bitcoin moving forward

Hey Thinkers 💡

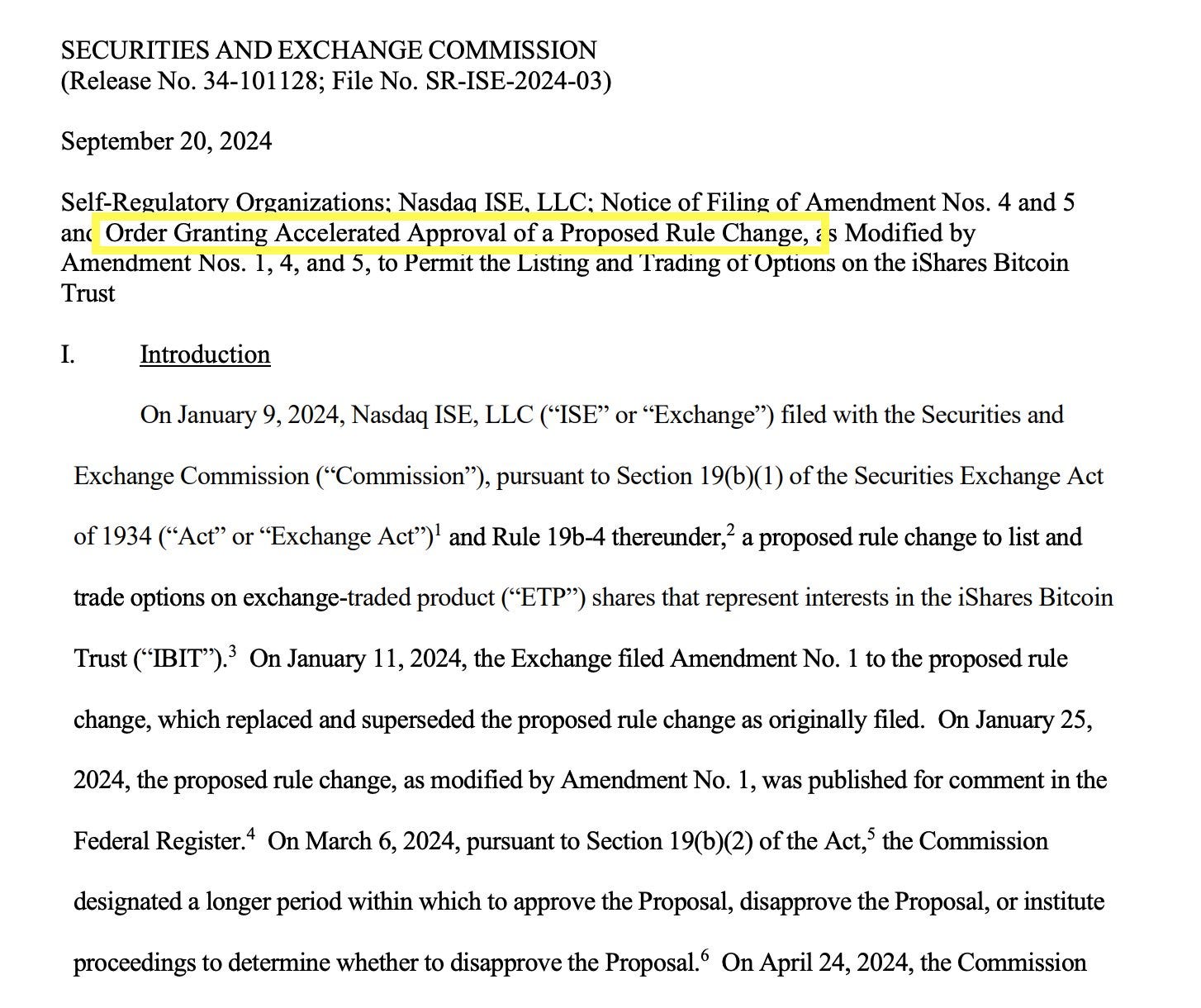

SEC Approves Options for BlackRock's Bitcoin ETF (IBIT)

After more than eight months since the first spot Bitcoin ETFs launched, the crypto industry celebrates another significant milestone—the SEC has approved options for BlackRock's Bitcoin ETF, known as IBIT. This development is more than just another product on the market; it signals growing institutional adoption and the continuous building of diverse financial instruments around Bitcoin and other cryptocurrencies.

Why This Matters

The approval of options for IBIT is a major win for the crypto industry as it opens up new avenues for investors to engage with Bitcoin. Options contracts allow investors to hedge their exposure, speculate on price movements, and increase market liquidity. The arrival of this financial tool helps to cement Bitcoin’s role as an institutional asset.

Industry Leaders Weigh In

Industry voices are excited about the potential of options trading for Bitcoin ETFs to enhance liquidity and boost institutional participation:

Michael Saylor, one of Bitcoin’s most vocal advocates, celebrated the news on Twitter(X), stating:

"The approval of options for IBIT will accelerate institutional Bitcoin adoption."Bloomberg ETF analyst Eric Balchunas added his perspective, saying:

"I'm assuming others will be approved in short order. Huge win for Bitcoin ETFs as it will attract more liquidity, which will, in turn, attract more big fish."

What Happens Next?

While the SEC's approval is a major step forward, it’s not the final hurdle. Eric Balchunas noted that this approval is just one stage in a multi-layer process. The options listing will still need the green light from the Office of the Comptroller of the Currency (OCC) and the Commodity Futures Trading Commission (CFTC). According to Eric, these entities don’t have a specific timeline, so there’s still some waiting ahead. But the fact that the SEC has made a positive move is a promising sign for the industry.

Looking ahead, Nate Geraci of The ETF Store highlighted the next major milestone for spot Bitcoin ETFs:

"Once options trading is live, the next milestone for spot BTC ETFs will be in-kind creation & redemption."

Conclusion: Momentum Is Building

The approval of options for BlackRock's Bitcoin ETF signals increasing acceptance of crypto in mainstream finance. As adoption continues, we are likely to see more innovative financial products built for both Bitcoin and altcoins. The next few months could bring further regulatory approvals, more liquidity, and greater institutional involvement—all of which bode well for the future of digital assets.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Gemini makes it easy to trade crypto with many unique features and prodcuts.

BitGo is one of the top custodians in the crypto industry. They provide the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📰 Latest Crypto News:

Coinbase announces plan to bring cbBTC to Solana network - source

BNY identified as First Bank to receive SEC Exemption from SAB 121 - source

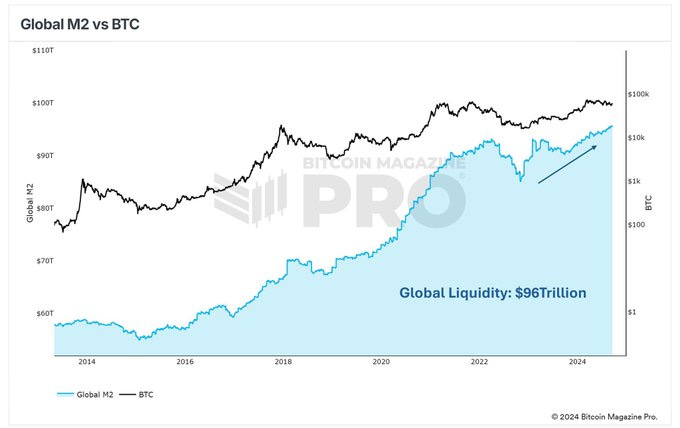

Global M2 money supply hit an all-time high.

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Bitcoin Whale Accumulation - Wallets with 100 to 1000 BTC continue to rise since the selloff in May 2024.

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Brian from Santiment breaks down the Crypto metrics around Fed Rate Cuts impact on Bitcoin and Altcoins. He also provides Ethereum and SUI analysis.

Amanda Tuminelli of the DeFi Education Fund discusses the first ever Congress DeFi hearing and the SEC’s continued attack against crypto.

___________________________________________

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony