📈 Bitcoin Breakout Amid Growing Crypto Market Structure Turmoil

Things are starting to look good for Bitcoin but crypto market structure is facing headwinds in Washington D.C.

Hey Thinkers 💡

This was a great week for Bitcoin.

We finally saw real strength as BTC broke out from $90K to over $97K. As expected, price has pulled back slightly for a healthy retest of support — but make no mistake, this move is different. It’s clear we are in the midst of the next rally, and frankly… it’s about damn time.

Bitcoin has been lagging:

The stock market

Gold and silver

Global liquidity

For a while, it even felt like BTC had completely decoupled. That gap is now starting to close.

📊 Is This Rally Legit?

In short: yes, the data supports it.

🐋 Whales Are Accumulating

On-chain data from Santiment shows Bitcoin whales have increased accumulation, a pattern that has preceded every major rally in this cycle.

📈 Technicals Confirm Strength

Daily RSI → plenty of room to run before being overbought

Daily MACD → bulls firmly in control

Weekly MACD → bearish momentum is fading

USDT dominance → breaking down, mirroring previous bull-market rallies

These signals don’t guarantee anything — but they significantly raise probabilities.

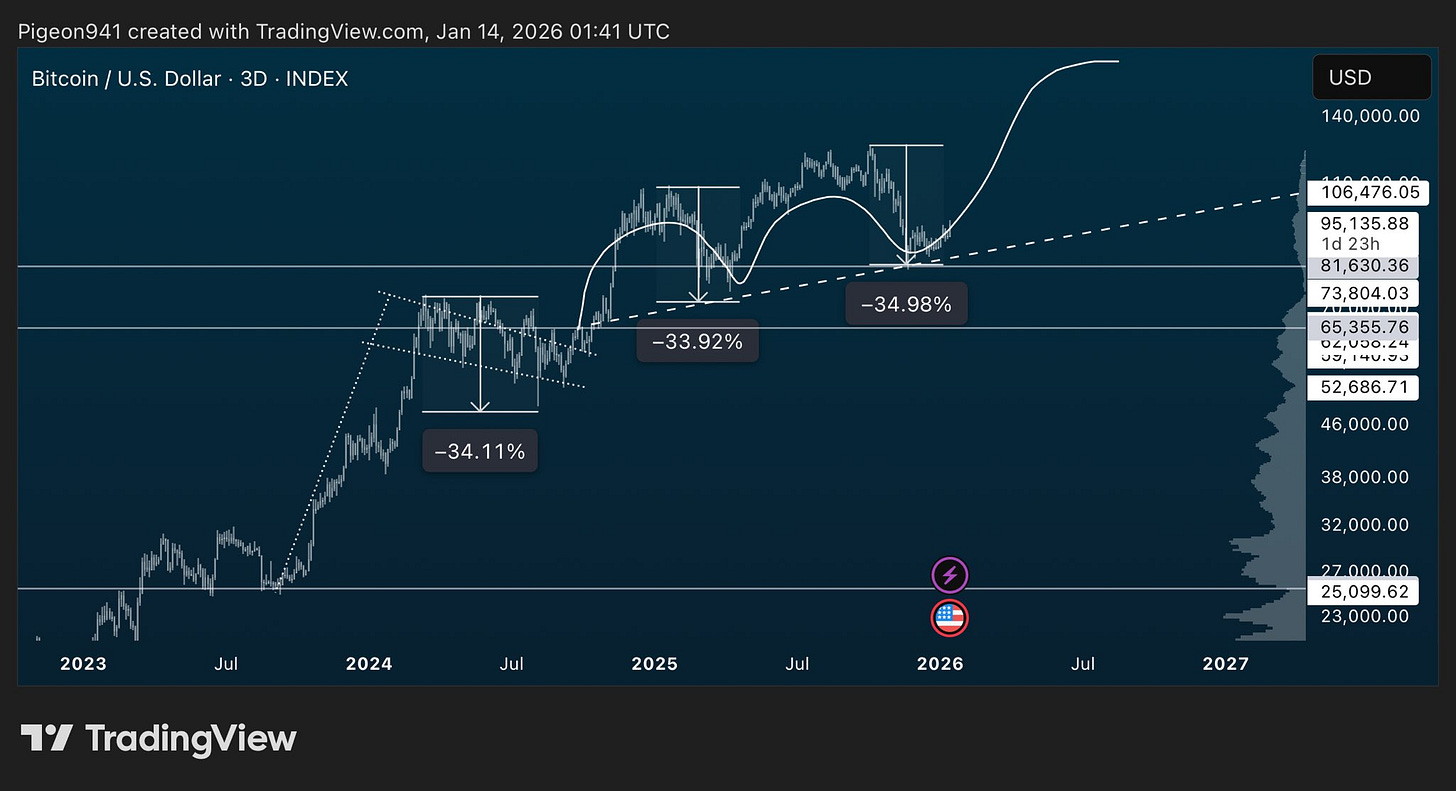

❓ Relief Rally or New All-Time Highs?

This is the debate raging between bulls and bears right now.

🐂 Bull Case

Some bulls believe this is the start of a move to new all-time highs, with targets as high as $144,000. Structurally, that’s possible — higher lows remain intact after the Q4 2025 correction.

🌍 Macro Tailwinds

The macro backdrop supports higher prices:

Central banks (including the Fed) are back to Quantitative Easing

Global liquidity is rising again

Crypto legislation milestones are approaching

Trump wants markets strong heading into midterm elections

There are no guarantees — only probabilities. The market will ultimately decide which scenario plays out.

🧠 What About Altcoins?

If Bitcoin continues higher, altcoins will follow.

The key question is whether they can make new all-time highs, which depends on BTC’s trajectory.

🔍 A Very Bullish Signal

The Russell 2000 has started making new highs.

Think of the Russell as the altcoin sector of equities.

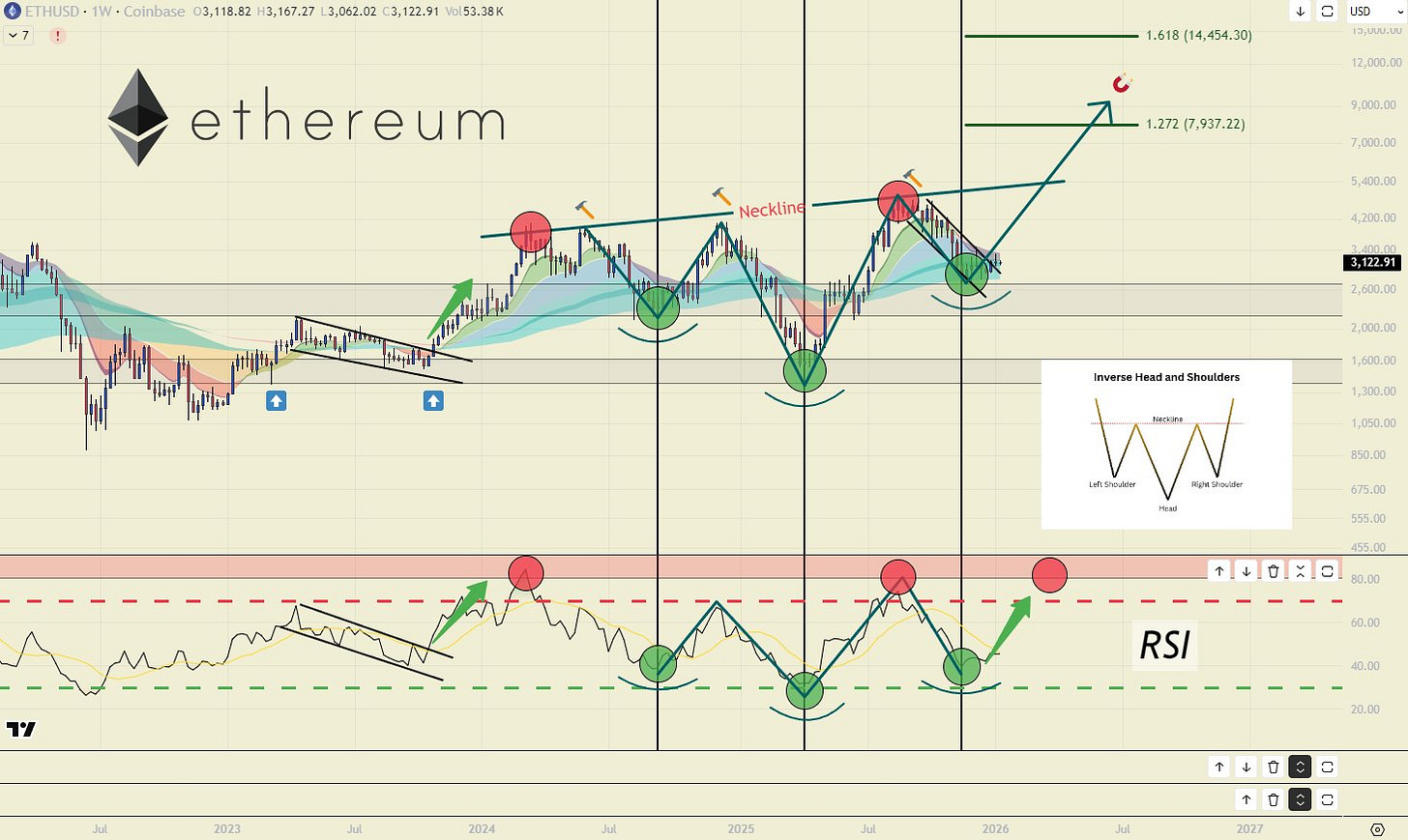

For altcoins, Ethereum serves as the benchmark:

We need to see ETH make new highs

That would be a major confirmation for a true altcoin rally

So far, the setup is constructive — but confirmation is still needed.

🏛️ Crypto Market Structure Bill Drama (CLARITY Act)

This week brought fresh uncertainty in Washington.

The Senate Banking Committee postponed a key vote on the CLARITY Act, following intense lobbying — particularly around stablecoin interest payments.

Key Developments:

Vote delayed by Chair Tim Scott to allow more negotiation

Coinbase CEO Brian Armstrong announced opposition, warning amendments could “kill rewards on stablecoins” and favor banks

Banking vs. crypto clash over whether stablecoin issuers can pay interest

Future uncertain, but lawmakers on both sides say they are committed to finding a path forward — likely pushing talks into February

This is a temporary setback, not the end of the bill — but it does inject short-term uncertainty.

🔥 Major Crypto News

🏦 State Street Launches Digital Asset Platform

State Street launched a new digital asset platform bridging TradFi and digital finance, offering:

Wallet management

Custody

Cash capabilities

Support for tokenized products across public and permissioned blockchains

🏛️ Standard Chartered Plans Crypto Prime Brokerage

Standard Chartered is preparing to launch a crypto prime brokerage housed within SC Ventures, expanding institutional access to digital assets.

📊 Nasdaq & CME Unify Crypto Indexes

Nasdaq and CME Group merged their crypto benchmarks, rebranding the Nasdaq Crypto Index as the Nasdaq-CME Crypto Index — a major step toward standardized institutional crypto benchmarks.

💳 BNY Introduces Tokenized Deposits

BNY launched tokenized deposit capabilities for institutional clients, mirroring deposits as on-chain digital entries while maintaining full regulatory compliance on a permissioned blockchain.

🏠 Crypto Recognized for Mortgage Qualification

Major U.S. lender Newrez will now recognize crypto assets for mortgage qualification — becoming the first top-25 mortgage lender to do so without requiring liquidation of digital assets.

This is a huge milestone for real-world crypto utility.

🧩 Final Thoughts

Bitcoin is finally catching up — technically, on-chain, and macro-wise.

Whales are accumulating

Liquidity is rising

Technicals are constructive

Institutions keep building

Whether this rally becomes simply a relief rally or a measured climb to new highs, one thing is clear:

👉 A strong rally is starting.

Stay patient. Stay data-driven.

The next phase is unfolding.

___________________________________________

💥Thank You to my show Sponsors

Propy (PRO) is a blockchain-based real estate marketplace and decentralized title registry that leverages smart contracts to facilitate property transactions globally. It simplifies and automates real estate transactions, making them faster, more secure, and more transparent.

Trezor produces quality crypto hardware wallets that make it easy for you to safely store your assets. It pioneered the development of self-custody for crypto assets, empowering individuals with an open-source device that enables secure and independent storage of cryptocurrencies.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

Learn about iTrustCapital’s powerful Premium Custody Account (PCA) and tax-advantaged Crypto IRA platforms. Get an exclusive $100 funding bonus!

___________________________________________

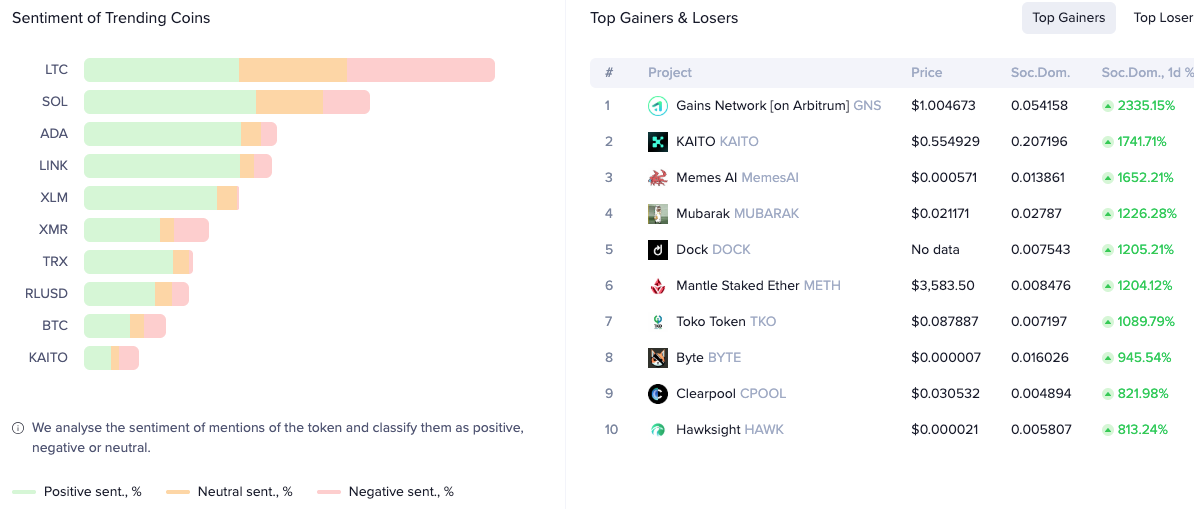

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

___________________________________________

📺 Recent Interviews

Bill Barhydt, Founder and CEO of Abra, joined me to discuss whether crypto market cycles have changed and what could come next for Bitcoin and altcoins.

Cody Carbone, CEO of The Digital Chamber, joined me to discuss the latest developments on the crypto market structure bill in the Senate—and more.

________________________________________

Support the Podcast

🖥️ Crypto Course

Learn Crypto with Expert Commentary from Founders, CEOs, and Institutional Investors. MyCryptoCourse.com

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony

Bitcoin to $105k, befote we get rejected