🚨BIG Week Ahead! 25 or 50 BPS Rate Cut?

How will the Fed Rate Cuts impact the markets and how much will they cut by?

Hey Thinkers 💡

50 BPS Rate Cut This Week?

This week, all eyes are on the U.S. Federal Reserve as the market anticipates a potential interest rate cut, with a decision expected on Wednesday, September 18th. There's considerable speculation about whether the Fed will cut rates by 25 or 50 basis points.

If the Fed leans towards a 50 basis point cut, we could see a significant positive response in risk assets, including stocks and cryptocurrencies like Bitcoin. Even with a more conservative cut, the broader macroeconomic conditions seem poised to push the markets upward.

Here’s why I think the bull market could continue:

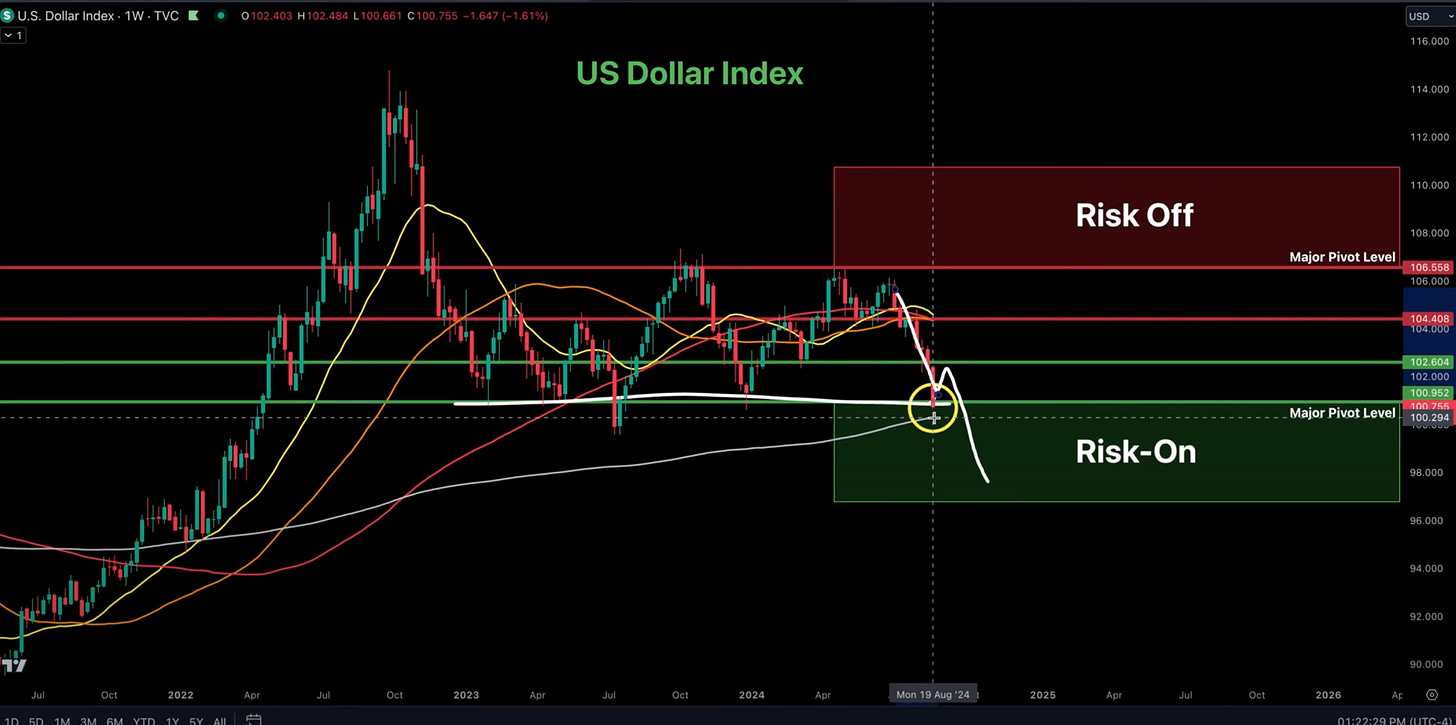

Dollar Weakness Could Spark a “Risk-On” Environment: A rate cut, especially a more aggressive one, could drive the Dollar Currency Index (DXY) below 100. A weaker dollar often pushes investors to seek higher returns in riskier assets, favoring sectors like tech, stocks, and crypto.

Money Market Exodus: Currently, there's a massive $6.32 trillion parked in Money Market Funds. As rates fall, the returns on these funds will become less attractive, encouraging investors to shift capital into risk assets like equities and digital currencies.

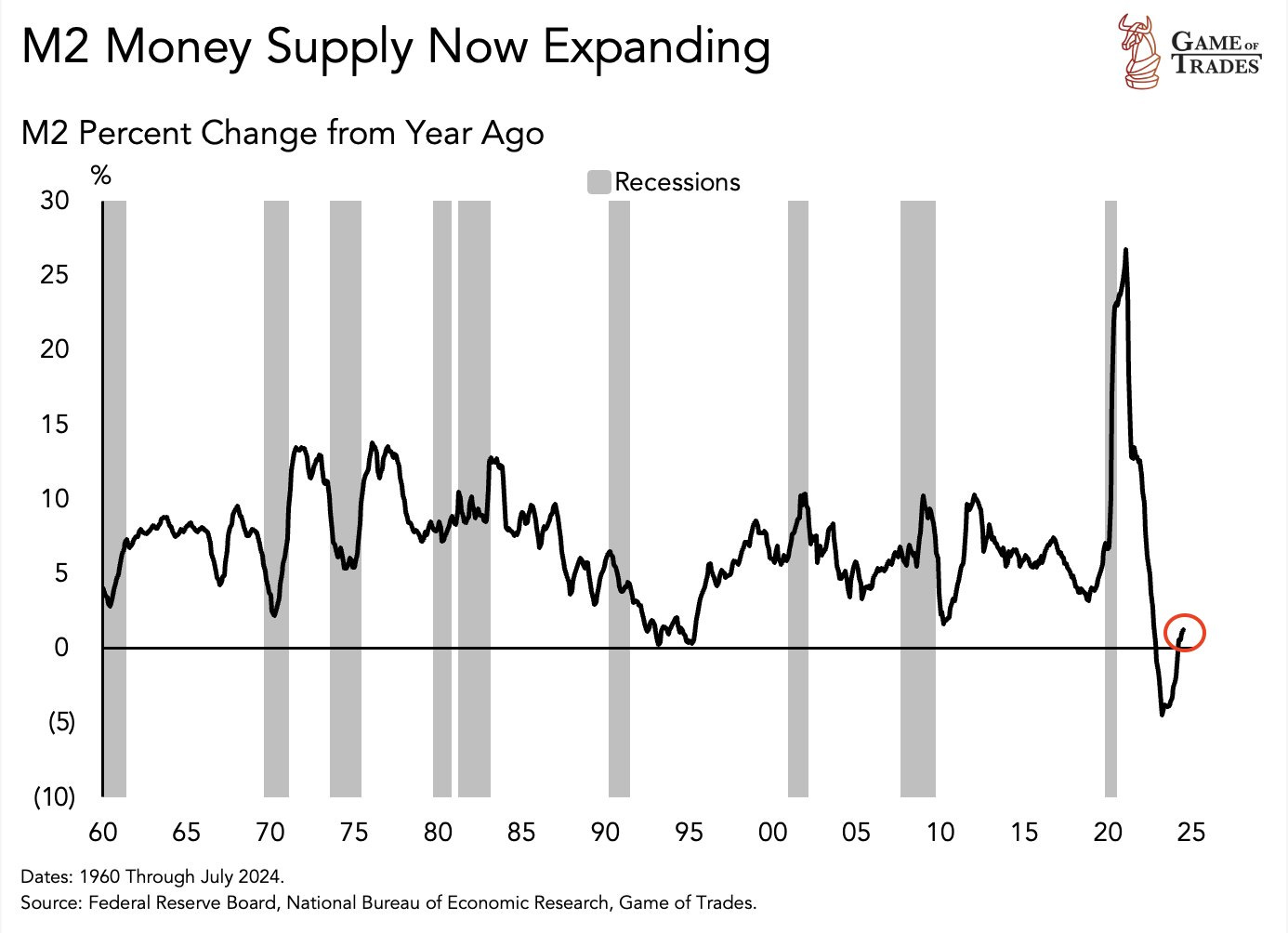

Liquidity is Rising: Both U.S. and global M2 money supply are on the rise. Expanding liquidity has historically led to higher asset prices. Game of Trades has highlighted how U.S. M2 money supply is rebounding after experiencing the deepest contraction since 1960. This influx of liquidity should provide additional fuel for rising markets.

Retail Investors Are Scared – A Contrarian Signal? From a market psychology perspective, retail investors often panic at the wrong time. The current fear sentiment suggests many believe the bull market is over, but historically, the herd’s sentiment tends to be a lagging indicator. The smart money usually takes the opposite side.

Whales are accumulating! Data from Santiment shows Bitcoin wallets with 100 to 1000 coins continue to rise. Also, Bitcoin’s supply on exchanges continues to drop. When the balance is high, it suggests more people may be preparing to sell Bitcoin, leading to an increased supply and potential price drops—ideal for short positions. Conversely, a low balance suggests fewer sellers and, thus, a potential price jump—great for long positions.

A Word of Caution: We’re Not Out of the Woods Yet

While the broader setup looks promising, it’s important to remember that the days surrounding an FOMC meeting typically bring high volatility. Historically, September is also a weak month for market returns, so brace for potential sharp pullbacks and high volatility as traders react to the Fed’s decision.

In summary, while we’re likely headed for more favorable conditions for risk assets, short-term turbulence could create buying opportunities for those with a longer-term outlook.

___________________________________________

💥Thank You to my show Sponsors

Uphold is one of the best crypto exchanges out there and I have been using them since 2018!

Gemini makes it easy to trade crypto with many unique features and prodcuts.

BitGo is one of the top custodians in the crypto industry. They provide the most secure and scalable solutions for the digital asset economy, offering regulated custody, borrowing and lending.

VeChain is a leading enterprise-grade L1 public blockchain, spearheading a digital revolution from a sustainable, highly scalable smart contract platform.

___________________________________________

📰 Latest Crypto News:

Circle is collaborating with Sony Block Solutions Labs to bring bridged USDC on Soneium via their Bridged USDC Standard! - source

Binance Founder CZ to be released from prison on September 29th.

The Kingdom of Bhutan now owns 13,011 Bitcoin worth $780.49 million - source

___________________________________________

📈Crypto Market Metrics

Here are some key data points from Santiment

Top 10 Coins Trending via Social Media

Developer Activity

The top 10 coins with the most developer activity over the past 30 days

___________________________________________

📺 Recent Interviews

Johann Kerbrat is the crypto general manager at Robinhood. We discuss Robinhood's vision for cryptocurrency.

Simon McLoughlin, CEO of Uphold, talks about the latest news with the crypto platform and his outlook for the crypto market.

___________________________________________

📖 ReThinking Crypto Book

Get the book on Amazon

-Tony